Honda confirms electrification push but snubs European automotive market

12 April 2022

Honda is to invest heavily in electrification and will launch 30 electric-vehicle models globally by 2030, with a production volume of two million units per year.

The Japanese carmaker will also build a demonstration line for the production of solid-state batteries by 2024 as it looks to shift its business away from internal-combustion engines. The announcements, made at a recent press briefing, did not include any reference to manufacturing in, or model development for, Europe.

A total of ¥5 trillion (€36.7 billion) is to be invested in electrification and software technologies to further accelerate this field. This funding will be provided over the next decade to help increase the company’s electric-vehicle (EV) ambitions. This includes both research and development expenses, and separate investments, which may also include partnerships with technology firms or other carmakers.

Sourcing EV batteries

One of the biggest challenges carmakers face in this modern age of motor production is the procurement of EV batteries. Honda has two approaches, one focused on the present and one from the second half of this decade.

The vehicle manufacturer has announced plans to strengthen external partnerships in certain markets when it comes to lithium-ion battery units. For the US, it will procure Ultium EV batteries from GM, while exploring the potential of creating a joint-venture company for battery production. In China, the company will strengthen its collaboration with CATL, and in Japan Honda will buy batteries for its mini-EVs from Envision AESC.

From 2025 onwards, Honda will further accelerate its independent research and development of next-generation EV batteries. For the all-solid-state batteries it currently has under development, Honda decided to build a demonstration line, investing approximately ¥43 billion, with a goal to make it operational in Spring 2024. Honda aims to adopt its next-generation batteries to models to be introduced to the market in the second half of the 2020s.

These batteries will be used in a series of new EV models that the carmaker plans to introduce, with specific plans for market introduction. By 2025, Honda will introduce two mid- to large-size EV models currently being developed jointly with GM for the US market. In China, a total of 10 new models will be introduced by 2027. By early 2024, Japan will see a new commercial-use mini-EV model in the ¥1 million price range. Then, Honda is planning to make a timely introduction for personal-use mini-EVs and electric SUV models.

Honda and Europe

Honda’s plans made no direct mention of Europe, highlighting the carmaker’s apathy towards the market. The company has closed its manufacturing plant in Swindon, UK, instead preferring to import vehicles from its facilities in Japan.

Last year, the carmaker took a 0.6% market share in the European passenger-car sector. Just 68,346 new Honda models took to the roads in 2021, down 15.3% on 2020.

It now seems that Europe is simply part of Honda’s ‘global’ plans rather than a dedicated target market. Instead, the company is focusing on its domestic market, together with China and the US for future growth.

Improving efficiency through internal organisation

‘As the world’s largest power-unit manufacturer with annual sales of approximately 30 million units of mobility products including motorcycles, automobiles, power products, outboard motors, and aircraft, we aim to realise carbon neutrality for all products and corporate activities Honda is involved in by 2050, striving to eliminate carbon emissions from power sources of a wide variety of products.,’ Honda executives stated. ‘To this end, Honda believes that a multifaceted and multidimensional approach is needed, not a mere replacing of engines with batteries.’

The carmaker is therefore looking at the development of swappable batteries and hydrogen fuel cells alongside the electrification of vehicles. As part of its plans, Honda will offer a variety of solutions for all mobility products according to how they are used in various countries and regions. As electrification may not suit some markets, this approach gives the company breathing space to continue to supply globally.

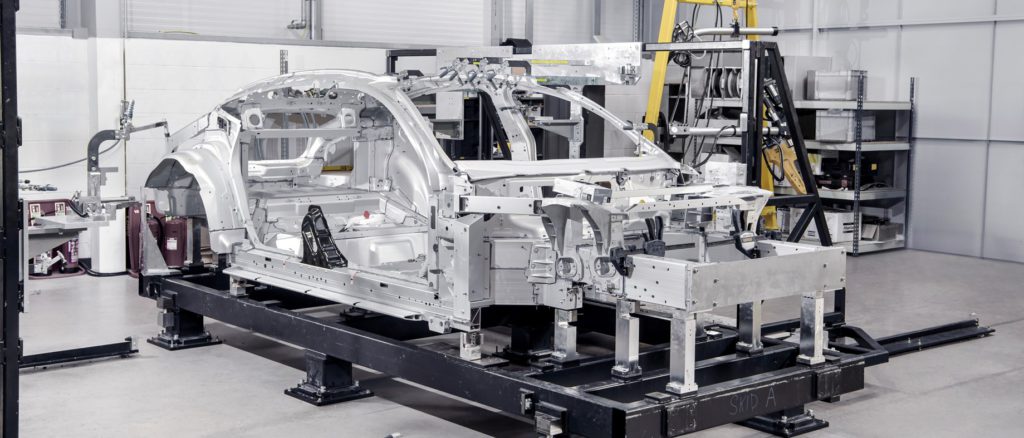

In the past, Honda divided its organisation by product groups, namely motorcycle, automobile, and power. However, starting this fiscal year, technology areas that will become the core of the company’s future business have been moved out and combined under the newly created Business Development Operations. Such core areas are electrified products and services, battery, energy, mobile power-pack, hydrogen, and software/connected technologies.