Monthly Market Dashboard: Return of rising RVs inspires improved outlooks

24 June 2021

Autovista24 senior data journalist Neil King considers the rising residual values (RVs) in the latest interactive monthly market dashboard (MMD).

The average value retention, represented in RV-percentage (%RV) terms, of cars aged 36 months and with 60,000km, improved month on month in all the big five European markets in June. The greatest growth was in the UK, where the %RV rose by 2.7% compared to May. The %RV is consistently higher in all markets compared to last year, ranging from 1.8% growth in Germany to 7.2% in the UK.

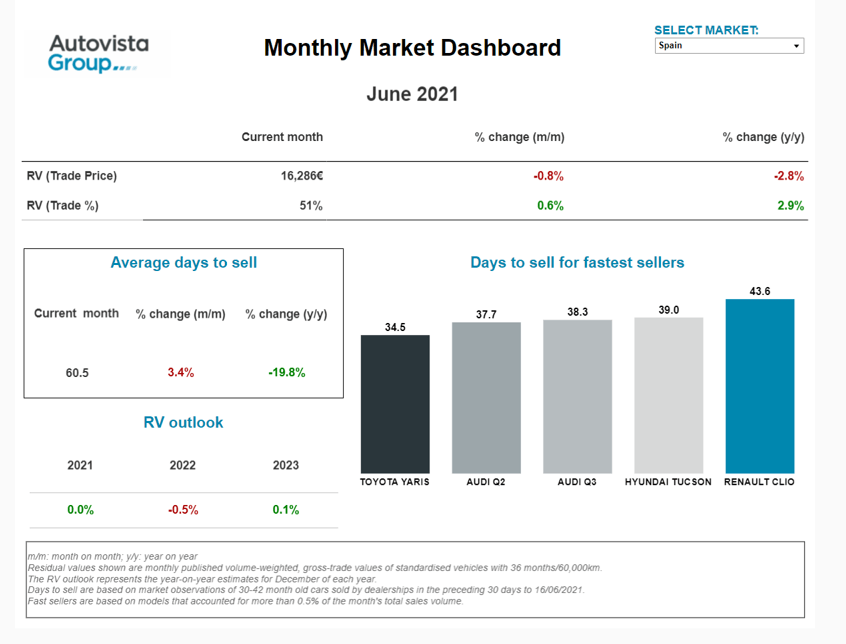

Average residual values (RVs), in trade-price terms, fell in Germany, Spain and the UK in June, compared to May. However, this is merely a reflection of the demand for small used cars given the economic fallout from the COVID-19 pandemic and as consumers seek out safe, cheap alternatives to public transport. Spain is a case in point, being the only market where RVs are lower in absolute pricing terms than last year.

The return of rising RVs across Europe in June, following the fragility in certain markets in April and May, has prompted brighter outlooks in Italy, Spain and the UK.

Unprecedented rises in UK values

The %RV in the UK is now forecast to increase by 3.5% year on year in 2021, It is forecast to contract by 4% and 1% in 2022 and 2023, respectively.

‘The UK’s wholesale used-car market spluttered back into life in April following lacklustre activity brought about by over three months of lockdown. Auction hammer prices were strong throughout May and have strengthened even further in June. Demand in wholesale channels is currently outstripping supply as dealers scramble to acquire as much stock as they can. This will lead to unprecedented rises in residual values as Glass’s reflects the spike in wholesale activity,’ explained Jayson Whittington, chief editor, cars and leisure vehicles, at Glass’s.

‘Whist we expect the heat in the market to subside in the final quarter of 2021, residual values will finish higher than they started. As long as the UK does not experience any further lockdowns, the expectation is that residual values will normalise in 2022, losing some of the ground gained throughout the past few turbulent months, but will not have lost any ground compared to 2020,’ Whittington added.

Brighter outlooks in Spain and Italy

In Spain, the resilient performance of the used-car market is helping to counterbalance the economic pressure the country is facing, although the crucial tourism sector is reawakening. The average %RV is now forecast to end 2021 at about the same level as in December 2020.

‘In the first half of 2021, there was a ratio of 2.2 used vehicles for each new-vehicle sale. In addition, supply shortages, as well as the semiconductor crisis, are making used-vehicle supply increasingly limited, relieving pressure on prices. Only battery-electric vehicles (BEVs) and, to a lesser extent, plug-in hybrids (PHEVs) continue to show a negative forecast. Their volume on the used-car market is increasing without the conditions for their integration, and the MOVES III incentive scheme is also having an impact on used-vehicle prices,’ said Ana Azofra, head of valuations and insights, Autovista Group, Spain.

The situation is similar in Italy but demand for used cars is less resilient. Nevertheless, RVs are now forecast to retreat by only 1.8% year on year in 2021, an upwards revision from the 2.3% decline that was previously forecast.

RVs are still forecast to decline in Germany in 2021, albeit by only 0.7%, but improve by the same margin in France.

Slower rehoming in France and Spain

Whereas RVs have risen in France and Spain over the last month, 30-42-month-old cars have been slower to sell in June than in May. The greatest rise in the number of stock days was in France, where used cars are taking 59.4 days on average to find a new home, 10% longer than last month. In Spain, the average number of stock days has increased by 3.4% over the last month, to 60.5 days. However, stock days were essentially stable in Germany and fell month on month in Italy and the UK, by 0.5% and 5.4%, respectively.

Nevertheless, used cars are moving on far more quickly than a year ago in all the major European markets, despite the resumption of dealer activity after months of lockdowns. The weakest improvement is in France, where the average number of days to sell is 5.6% lower than during the same period last year. At the other end of the spectrum, used cars are selling after an average of 36.9 days in the UK, 53% quicker than a year ago.

The Range Rover Evoque in the UK was the fastest-selling car in the major European markets in June, taking on average just 18.6 days to find a new home. The second and third fastest sellers in June were in the UK too. The Mercedes-Benz GLA and the Ford Kuga are moving on after an average of just 19.1 days and 21.2 days, respectively.

Click here or on the screenshot above to view the monthly market dashboard for June 2021.