Monthly Market Update: Residual-value growth slows in May as used-car sales cool

31 May 2022

Used-car sales activity cooled in May 2022 across most of the key West European markets, with the sales-volume index even suffering double-digit month-on-month declines in France and Spain. Limited used-car supply is combining with weaker demand because of the economic situation, high inflation, and consumer uncertainty stemming from the war in Ukraine. Nevertheless, residual values (RVs) have gained slightly, apart from in the UK.

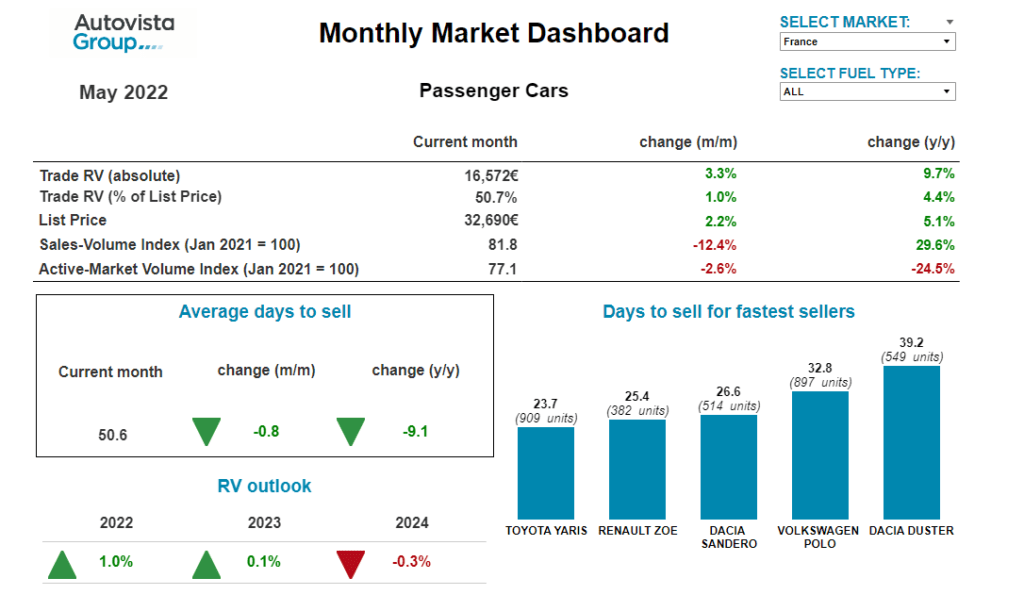

Autovista Group’s used-car coverage in the monthly market dashboard features Austria, France, Germany, Italy, Spain, Switzerland, and the UK. It also includes a breakdown of key performance indicators by fuel type, average new-car list prices, as well as sales-volume and active market-volume indices.

New-car supply stabilising, list prices rising

Western Europe’s major new-car markets endured double-digit declines in April as the war in Ukraine continued to disrupt supply chains and delay vehicle deliveries. However, the downturns were less severe than in March, albeit only when adjusted for working days in all countries except Spain. Italy was in line with expectations and the slightly weaker-than-expected results in France and Germany were almost balanced out by strong performances in Spain and the UK.

Autovista24 assumes that the impact caused by the Ukraine war is lessening, as alternative sources of raw materials and parts are secured. Following the disruption caused to manufacturers, such as the BMW and Volkswagen (VW) groups, there have been no major additional production stoppages announced over the last month.

As the April new-car registration figures were closely aligned with Autovista24’s assumptions and, moreover, yielded no further shocks, the volume forecasts for May and June have only been subtly amended. Although pre-existing supply challenges will continue throughout 2022, and could even persist until 2024, the outlook for the second half of the year has been broadly maintained.

Inflation is rising however, with the latest consensus suggesting it will sit around 7% for 2022 in the European Union and the UK. This rise has been spreading into the automotive sector, underpinned by the ongoing supply shortages of new and used cars. Price rises are being further compounded by a steep ascent of raw-material and energy costs as a result of the Ukraine war.

Autovista24 expects the trend of rising new-car prices to continue as long as supply constraints remain ubiquitous. This will positively affect used-car prices as well – if demand cannot be met on new-car markets, buyers will turn to used models and this supports price realisation. Carmakers will have no other choice than to increase prices to support their margins. Not all vehicle powertrains are affected in the same way, however. Prices for internal-combustion engine (ICE) models have been rising more than those of electric vehicles (EVs) over the past year.

In this context of used-car supply challenges and cooling demand but with inflationary pressure, the Autovista Group residual-value outlook for 2022 has been upgraded in Austria, Italy, and Switzerland this month. The outlooks for France, Germany, Spain, and the UK are maintained.

Stable used-car demand outstrips supply in Austria

The Austrian used-car market continues to be underpinned by stable demand and low supply. On average across all passenger cars aged two-to-four years, the supply volume in May was 16.5% lower than in May 2021, highlights Robert Madas, Eurotax (part of Autovista Group) regional head of valuations, Austria, Switzerland, and Poland. Already in 2021, supply was significantly lower than at the beginning of 2020.

Diesel cars are especially missing from the market, with a drop of 22.4% compared to May 2021. However, the availability of used battery-electric vehicles (BEVs) showed an even stronger downward trend again, with a drop of 39.7% year on year. Market activity shows strong used demand for hybrids of all types, leaving their supply somewhat short too.

Despite the ongoing context of used-car demand outstripping supply, days to sell have increased slightly compared to April, to an average of 56.4 days. Hybrid-electric vehicles (HEVs) are selling the fastest, averaging 48.6 days, followed by diesel cars with 55.8 days, and plug-in hybrids (PHEVs) with 56.4 days. BEVs are selling the slowest, averaging 61 days.

This market environment has led to a further increase in RVs of 36-month-old cars, in both value and retention (%RV) terms. The %RV rose by 21.1% year on year in May, with cars retaining 52% of their list price on average. HEVs are currently leading with a trade value of 53%, followed by petrol cars (52.8%) and diesel cars (52%). 36-month-old BEVs retain the lowest value, at 45.5% of list price.

Madas assumes that the market parameters will not change in the medium term, because new-car registrations are still markedly lower than before the crisis (2021 was down 27% compared to 2019). The supply of new cars will be the key factor in the future development of RVs. Supply chains were already disrupted and together with the semiconductor shortage, the war in Ukraine is leading to even longer delivery times for most new vehicles.

Due to this undersupply, RVs of three-year-old passenger cars are expected to continue to rise this year. Only when the new-car market picks up significantly, and thus volumes on the used-car market also increase, are values likely to come under pressure. This will probably not be the case before 2023.

List prices, not market dynamism, drive RVs in France

For all fuel types, there is now a stabilisation trend of residual values in France, despite a strong reduction of used-car sales volumes. ‘The modest increase in May is more the result of list-price increases than market dynamism. Used-car buyers are no longer accepting high prices and purchasing decisions are being increasingly delayed because of current uncertainties,’ commented Yoann Taitz, Autovista Group regional head of valuations and insights, France & Benelux. This phenomenon is also visible when considering stock days, which are stabilising even though used-car supply is decreasing.

RVs of hybrid vehicles have peaked during the last three months and are now stable. However, the reduction in stock days confirms that hybrids remain dynamic on the used-car market, representing the best compromise between ecological, economic, and financial concerns.

Following the vigour of recent months, the increase in values of BEVs is now less significant. ‘I still consider that the BEV sales performance increase observed lately is rather a temporary phenomenon, especially driven by fuel prices. As fuel prices have been below €2 per litre for several weeks, BEVs are less attractive,’ said Taitz. But this is also because of adjustment effects. While in the last quarter of 2021, RVs increased across most powertrains, BEVs were steadily decreasing.

Despite the positive adjustment in recent months, the value retention of BEVs is still about 20 percentage points below other fuel types, while the supply is very low compared to ICE vehicles. ‘The BEV RV increases observed lately are also the result of the arrival of new-generation models with greater range as 36-month-old used cars,’ Taitz added.

Finally, there is not a clear agenda for the BEV market in the coming months, with hype from the French government about extending the incentives in 2022, but no action. This is breaking the potential for BEV demand and prices, and further explains the less dynamic trend observed in May.

‘The air is now becoming thin’ in Germany

On the new-car side, April was a bitter setback for the industry in all sales channels in Germany, falling short of the already weak result of the previous year for the second month in a row. ‘While the more profitable SUVs are reaching the registration offices in weakening – but still reasonably solid – quantities, classic body styles more than halved in April compared to the pre-crisis period,’ notes Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group).

Two effects come together here: the supply crisis, but also the change in customer preference towards SUVs. The comparatively higher volumes, however, also ‘give the high-legged models a lower uplift effect in average prices in the used-car market,’ Geilenbruegge commented. The higher list-price level and the already strong residual values before the COVID-19 pandemic have left less room for improvement. ‘As expected, the air is now becoming thin at the elevated general price level. Potential buyers’ financial worries about the future and rising living and energy costs are apparently making them hesitate more and more when faced with used-car prices that were unimaginable just a year ago,’ Geilenbruegge added.

Dealers have obviously noticed this and have stopped the extreme price spiral for the time being. In all areas, the offer-price level is stagnating while the stock of higher-priced used cars is slowly decreasing. It is also interesting to note that despite the flood of registrations of BEVs and PHEVs over the past two years, the used volumes on offer have stagnated or even declined – despite sales figures that have also stagnated. ‘The export of these vehicles now seems to be so established in the industry that this not only regulates the price pressure but is also profitable. The question will be how receptive the target markets still are,’ Geilenbruegge concluded.

RVs fall in line with list prices in Italy

In May, the average residual value of a 36-month-old car with 60,000km decreased slightly in Italy, by around 1.9% compared with April, to €16,394. Similarly, there was also a 1.8% drop in new-car list prices. The sharp drop in new-car registrations, which have suffered a year-to-date contraction of 26.5% – the worst result among the big five European markets – is certainly one of the main reasons to explain this phenomenon. ‘We will see in the coming months whether the state incentives, officially reintroduced in Italy on 25 May, will succeed in reversing the trend,’ commented Marco Pasquetti, forecast and data specialist, Autovista Group Italy.

Analysing residual values of the various fuel types in %RV terms, petrol cars (+0.1%), BEVs (+0.2%) and HEVs (+1.3%) were the only ones to maintain an upward trend compared to April. RVs of plug-in hybrids, on the other hand, are falling the most, with a 1.8% decline month on month and an average sales time that has risen to 84 days. Diesel RVs fell slightly (down 0.4%), but the powertrain has the highest residual values as a percentage of list price, at 52.5%. ‘Apart from the ban in some large cities, diesel engines are still considered profitable and reliable, without particular disadvantages,’ Pasquetti explained.

Compared to April, RVs of used cars with LPG and CNG powertrains only receded modestly, by 1% and 0.8% respectively. Gas-powered vehicles continue to be very popular in Italy and still account for close to 10% of the new-car market – higher than BEVs and PHEVs.

Retraction in used-car demand in Spain

For almost a year now, the Spanish new-car market has been weighed down by a shortage of supply, largely due to the semiconductor crisis, with a cumulative fall of 12% so far in 2022. ‘In May, in addition to the lack of product, there has been a certain retraction in used-car demand because of the economic situation – especially due to high inflation – and, in general, by the uncertainty generated by the war in Ukraine,’ explains Ana Azofra, Autovista Group head of valuations and insights, Spain.

In the used-vehicle sector, sales also continue to fall month by month and more and more sharply. The latest reported year-on-year decline was 17% in April. ‘However, these small signs of lowering demand do not yet pose an additional problem to the shortage of product: supply is still far below demand and transaction prices are not under any pressure, but continue to grow,’ Azofra commented. Specifically, the average residual value was 2.5% higher in May than in April and 12% higher than a year earlier.

So far, the only sign that could be pointing to a change is the lengthening of the days needed to sell (up nine days compared to April) and the increasingly ageing used-vehicle profile. ‘Four out of 10 used cars sold in May were more than 15 years old, which continues to increase the average age of the Spanish car fleet,’ said Azofra.

Therefore, the shortage of product continues to slow down the recovery of the used-car market and is significant in the younger segments, demand for which has long been unsatisfied by demonstrator models and the rental sector, one of the channels that is suffering the most from the shortage of used cars.

In the face of the shortage, avenues are opening up for fuel types that previously faced more barriers, such as BEVs, which saw average RVs for a three-year-old car improve by 2.3% in May compared to April.

The light-commercial vehicle sector continues to be one of the most affected, both in the new- and used-car markets. The shortage of used vehicles is relevant, and residual values are rising steadily. ‘Alternatives are being sought in segments that can cover commercial needs, making used cars such as the Peugeot Rifter one of the fastest sellers in May,’ Azofra concluded.

Used-car demand falls in Switzerland

For almost two years, the Swiss used-car market was characterised by high demand, low supply and rising used car-prices. On average across all two-to-four-year-old passenger cars, the supply volume in May was 3.8% below the level of a year earlier, but the sales-volume index declined 18.3%, notes Hans-Peter Annen, head of valuations and insights, Eurotax Switzerland (part of Autovista Group).

Diesel cars in particular are missing on the market, with supply 21.4% down compared to May 2021. For petrol cars, there are currently 4.8% more two-to-four-year-old models offered than a year ago. The offered volume of PHEVs is around 31% higher than in May 2021 whereas the volume of BEVs has decreased by 16.3%, with demand significantly exceeding supply.

The average days to sell decreased slightly in May, with a passenger car aged two to four years in stock for 58.5 days. HEVs are selling quickest, with an average of 50.5 days, followed by petrol cars with 57 days, diesels with 59 days, BEVs with 69 days, and PHEVs with 70 days.

Despite cooling used-car demand, the average %RV of 36-month-old passenger cars increased to 49.1% in May (up 1.8% month on month and 19.2% year on year). Petrol cars posted strong year-on-year %RV gains of 18.7%, to 50.0%, as too did diesel cars (up 19.1% to 47.3%).

The disrupted supply of new cars, exacerbated by the war in Ukraine, is a key factor in the future development of RVs as well as the recent list-price increases. Supply chains are heavily affected for different parts and raw materials, leading to long delivery times for most new vehicles. As new-car registrations in 2022 are markedly lower than before the COVID-19 pandemic (2021 was down 23.4% compared to 2019), the market parameters will not change in the medium term. Annen forecasts that RVs of three-year-old used cars will continue to rise this year, before eventually stabilising and declining over the years 2023 and 2024.

UK buyer activity picks up during May

The UK’s wholesale used-car market remained slow at the beginning of May, and the average residual value (RV) of a three-year-old car fell by 4.4% compared to April. RVs are still 23.9% ahead of last year, however, due to the significant growth seen in the second half of 2021, highlights Jayson Whittington, Glass’s (part of Autovista Group) chief editor, cars and leisure vehicles.

‘Demand in auction channels remained weak in early May, as too was vehicle supply, but as the month progressed buyer activity began to increase. The average number of days it took a dealer to sell a used car fell by two days month on month in May, so it seems that retail activity is improving, and dealers are needing to replenish stock more frequently,’ Whittington commented.

Although residual values are falling in the UK, the reason they have not dropped significantly is due to poor supply. Autovista Group’s active-market volume index shows that the volume of 24-48-month-old cars fell 8.1% in May compared to April. Compared to May 2021, the volume was down 3.8%, which given that the UK had only recently emerged from over three months of lockdown last year, with very small volumes of used cars moving through the market, this year appears especially short of used cars.

Glass’s expects residual values to continue to decline throughout 2022 and that will be around 12% lower than in December 2021 by the end of the year. ‘Although a far cry from the growth we saw last year, this is by no means unusual as ordinarily cars are considered a depreciating asset. As we move forward, we will see the year-on-year growth figure of 23.9% dip significantly, as RVs rose sharply from June 2021 and are expected to continue falling this year,’ Whittington concluded.

The May 2022 monthly market dashboard provides the latest pricing, volume and stock-days data.