No improvement for EU’s key new-car markets with orders unfulfilled in October

03 November 2021

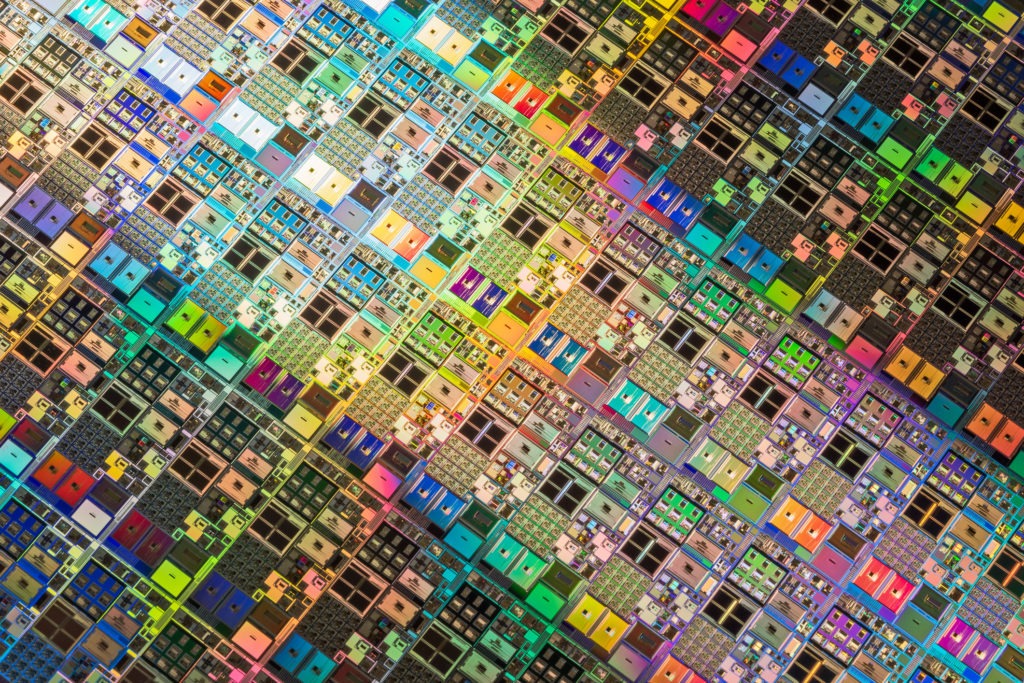

Autovista24 senior data journalist Neil King discusses how the shortage of semiconductors continued to leave orders of new cars unfulfilled in October, impeding the anticipated recovery of the EU’s largest markets.

New-car registrations in France, Germany, Italy, and Spain declined by at least 35% in October, compared to 2019, with greater downturns reported than a month earlier. The contraction in Germany was especially significant as it followed a cautionary improvement in September.

The shortage of components means orders continue to go unfulfilled and are not being converted into registrations. Furthermore, easing of the bottlenecks is not expected to materialise until 2022 and will remain an issue in the coming months. Accordingly, Autovista24 has revised its 2021 forecast for all four markets further downwards.

As registrations across Europe endured troughs because of COVID-19 lockdowns and peaks as pent-up demand was released, year-on-year comparisons with 2020 are incredibly volatile. Therefore, this article focuses on the latest developments compared to 2019, which better represents the true performance of new-car markets.

France’s weakest monthly comparison this year

According to data released by Plateforme Automobile (PFA), the French automotive-industry body, 118,521 new cars were registered in the country in October. Compared to 2019, the market contracted by 37.3%, a deterioration from the 22.8% decline in August. This represents the poorest comparative performance of 2021. The volume was 30% below the average of just under 170,000 registrations for the month between 2010 and 2019.

On a positive note, however, there were two fewer working days last month than in October 2019 and, on an adjusted basis, Autovista24 calculates that the market fell by 31.3%. Nevertheless, this is still greater than the adjusted 26.3% contraction in September.

In addition to COVID-19 and semiconductor shortages, the reduction in French incentives for electrically-chargeable vehicles (EVs) since 1 July has also impacted demand. Consequently, cumulative registrations in the first 10 months of the year were 24.7% lower than in the same period in 2019, down on the 23.2% contraction in the first three quarters. The reduction of EV incentives have stabilised the market shares of both plug-in hybrid electric vehicles (PHEVs) and battery-electric vehicles (BEVs), at 8.2% and 8.9%, respectively. However, a further planned reduction of the incentives from 1 January 2022 has been scrapped, with the subsidies remaining in place until 1 July 2022.

Given the latest market development and an expected impeded recovery into 2022, Autovista24 has downgraded its forecast to 2.2% year-on-year growth in 2021, following the 25.5% contraction in 2020, to below 1.69 million units. This is 23.9% lower than the volume of cars registered in pre-crisis 2019.

Significant deterioration in Germany

New-car registrations in Germany amounted to 178,683 units in September, equating to a decline of 37.25% compared to the same month in 2019, according to the latest figures released by the Kraftfahrt-Bundesamt (KBA).

This marks a significant deterioration from the 19.5% decline in September, although there was one less working day last month than in October 2019. Nevertheless, even on an adjusted basis, Autovista24 calculates the market contracted by 34.3%, down on the adjusted 23.1% fall in September.

In addition to rising energy costs and the constrained supply of new cars due to the shortage of semiconductors, Germany has also endured a recent rise in COVID-19 infections. These factors are all conspiring to impede the recovery of the new-car market, with the year-to-date contraction in the first 10 months of 2021, compared to the same period in 2019, retreating slightly to 27.4%.

In turn, the outlook for the remainder of the year has weakened, with chip shortages expected to persist into 2022 and possibly 2023. Furthermore, rising energy costs in the country have caused a further spike in year-on-year inflation to 4.5% in October, according to the Statistisches Bundesamt (Federal Office of Statistics). Private buyers accounted for a 38.1% share of the market in October, but this is expected to diminish as inflationary pressure dents consumers’ disposable income and confidence.

Given the inflationary pressure and no improvement in delivery delays envisaged in the short term, Autovista24 has reduced its forecast for 2021 to 2.66 million new-car registrations. At this level, the market will be 8.8% smaller than in 2020 and 26.3% down on 2019. This would also make it only the third year the country registered fewer than three million new cars since 2010.

‘Delays of many months’ in Italy

In Italy, industry association ANFIA reported that 105,015 new cars were registered last month. Compared to October 2019, the market contracted by 35.8%, a decidedly sharper drop than the 26.2% fall in September. However, as in France, there were two fewer working days. On an adjusted basis, Autovista24 calculates that the market fell by 29.6%, the same as the adjusted contraction in September.

‘The raw-materials crisis, particularly for semiconductors, is generating delays of many months in vehicle production and delivery times,’ commented Paolo Scudieri, president of ANFIA.

Additionally, the latest refinancing of the Ecobonus incentives, funding for which was exhausted in early September, came too late to stimulate the market last month.

‘The refinancing of €100 million from the automotive fund for the purchase of low-emission vehicles, envisaged by the legislative decree of 21 October, only became operational from 27 October, thus having a very marginal impact on the trend of registrations for the month. This further confirms the fact that the constant stop and go of the incentives is not beneficial to the market,’ Scudieri emphasised.

Short-lived support

The new-car market has further retreated from its cumulative 20.6% decline in the first three quarters of 2021 to a 22.1% contraction through to October.

Although the refinancing of incentives may boost demand for EVs, any positive effect will be short-lived. ‘The Ecobonus fund for cars in the 0-60g/km CO2 range is already near exhaustion - without prejudice to the indisputable usefulness of the refinancing,’ Scudieri explained.

Moreover, the pace of conversion of new-car orders into registrations is not expected to improve until 2022. Accordingly, Autovista24 has subtly reduced its forecast for this year, predicting year-on-year growth of 8.6%, to 1.5 million units. At this level, the market will be 21.8% smaller than in 2019.

Scudieri added that ‘it is essential that in the 2022 budget law, also considering the commitments that Italy will sign at the end of COP26 currently underway in Glasgow, a three-year measure is envisaged to support the market for low-emission passenger cars and light-commercial vehicles, as part of an accompanying plan for the energy transition and productivity of our sector.’

Supply shortages mask demand in Spain

A total of 59,044 new cars were registered in Spain during October, according to ANFAC, the Spanish vehicle manufacturers’ association. This is the lowest tally for the month since 2012 and equates to a market contraction of 37.2% compared to two years ago. At first glance, this marks a significant deterioration on the 27% downturn in September. However, there were three fewer working days than in October 2019 and, on an adjusted basis, the downturn was 27.7% last month, improving slightly on the adjusted 30.4% decline in September.

The reduction of car-registration taxes in the country since 1 July is undoubtedly having a positive effect on demand, but this is masked by supply shortages delaying deliveries. Compared to the first 10 months of 2019, cumulative registrations of new cars are down 33.3%. This is slightly down on the 32.9% fall in the first three quarters as the Spanish market contends with the fallout from COVID-19 and inflationary pressure, as well as the chip shortage.

‘Registrations continue in free fall in a context where, basically, there is no supply to meet the demand due to the global chip crisis. This means that the deliveries of the orders processed by the distribution networks last up to six or eight months on average,’ commented Tania Puche, communications director of the Spanish dealers’ association GANVAM.

Year-end boost to ‘reasonable’ order intake

There is some positivity, however, as order intake remains healthy despite the delivery delays and is expected to receive a boost from the planned rise in the vehicle-registration tax from 1 January 2022.

‘We detect customers have internalised that they have to wait longer than normal for their vehicle but are making their purchases normally, whereby, already in November, the level of orders is reasonable,’ said Raúl Morales, communications director of Faconauto.

‘We can speak of an improvement in the commercial activity of dealerships that, between now and the end of the year, should be further improved by customers who want to avoid the increase in registration tax that will take place on 1 January next year,’ he added.

Nevertheless, given the limited impact of the July registration-tax cut in Spain and the ongoing economic and supply issues, Autovista24 has revised its forecast for 2021 down to 867,000 units, equating to year-on-year growth of 1.9%. This follows a 32.4% contraction in 2020 and, with this weakened outlook, the Spanish market will be 31.1% smaller this year than in 2019.

‘The forecasts suggest that 2021 will be another black year for the automotive industry after the blow of the pandemic, with closing figures below 900,000 units,’ Puche concluded.