Plug is pulled on UK plug-in car grant

15 June 2022

The UK government has ended the plug-in car grant (PiCG) scheme, which offered up to £1,500 (€1,740) off the cost of a new electric car. Transport Minister Trudy Harrison claimed the country’s electric-car market has been successfully kick-started and signalled the need to send funds elsewhere.

News of the decision was not well received. The UK’s Society of Motor Manufacturers and Traders (SMMT) underlined the poor timing of the decision. With rising fuel prices and supply shortages exacerbated by the war in Ukraine, more consumers were considering an electric vehicle.

An electric revolution?

The UK government claims the PiCG helped kickstart the UK’s electric revolution, supporting the sale of nearly half a million electric cars. The sale of battery-electric vehicles (BEVs) reportedly went from less than 1,000 in 2011 to almost 100,000 in the first five months of 2022. After rising 70% year on year, BEVs now make up one-in-six new cars joining the road.

Funding behind the incentive was slated to last until 2022-2023 the government confirmed. It pointed out that even after previous reductions in grant size and applicable models, there was little impact on the accelerating adoption of electric cars, or the growing number of available models.

‘The government continues to invest record amounts in the transition to EVs, with £2.5 billion (€2.9 billion) injected since 2020 and has set the most ambitious phase-out dates for new diesel and petrol sales of any major country. But government funding must always be invested where it has the highest impact if that success story is to continue,’ said Harrison.

Shifting focus

At launch in 2011, the PiCG offered users £5,000 towards a new electric car. A reduction in December 2021 saw this amount whittled down to £1,500, with the purchase ceiling lowered to cars with a £32,000 price tag.

Withdrawing this last offering, the government said the savings that can be made by running an electric car compared to a petrol or diesel equivalent far exceeds the £1,500 incentive. Additionally, those with an electric car will continue to benefit from zero road tax and ‘favourable’ company-car tax rates that can help save over £2,000 a year.

The number of people benefitting from this could grow as the government looks to bolster electrification in other segments. £300 million in funding will go towards grants for plug-in taxis, motorcycles, vans, trucks, and wheelchair-accessible vehicles, as well as other EVs.

‘Having successfully kickstarted the electric-car market, we now want to use plug-in grants to match that success across other vehicle types, from taxis to delivery vans and everything in between, to help make the switch to zero-emission travel cheaper and easier,’ Harrison added.

Investing in infrastructure

Elsewhere, the government hopes a £1.6 billion injection of funds will help increase the number of public charging points across the country to 300,000 by 2030. This would represent a 10-fold increase up from the 30,000 currently available.

Volkswagen Financial Services (VFS) recently referenced a forecast made by the Competition and Markets Authority (CMA) that the UK will need at least 480,000 public points by 2030. However, VFS did acknowledge that this number does not account for the 300,000 points installed at people’s homes, reducing reliance on a public network. The real challenge will be getting infrastructure where it is needed, combatting the present uneven spread of plugs across the country.

Wrong message, wrong time

‘The decision to scrap the plug-in car grant sends the wrong message to motorists and to an industry which remains committed to government’s net-zero ambition,’ commented Mike Hawes, SMMT chief executive.

He welcomed the government’s support for new electric-van, taxi, and adapted-vehicle buyers. However, Hawes pointed out that the UK is now the only major European market to have zero upfront electric-car purchasing incentives, alongside ambitious uptake plans.

‘With the sector not yet in recovery, and all manufacturers about to be mandated to sell significantly more EVs than current demand indicates, this decision comes at the worst possible time,’ he added. To hit electric targets, Hawes emphasised the need for these savings to be invested in the charging network.

Rising fuel prices

Meanwhile, consumers will need to navigate rising fuel prices. A poll commissioned by the UK’s Motor Ombudsman revealed nearly half of its 2,000 respondents are concerned about owning a petrol or diesel car due to record prices at the pump. The cost of filling up an average family car with a 55-litre fuel tank recently hit £100 for the first time, whilst the price of petrol has equally surpassed £8 per gallon.

‘With fuel costs at unprecedented levels, and the likelihood of further increases coming, as we approach the height of summer, it is clear from our survey findings that the prospect of electric-vehicle ownership is becoming increasingly attractive,’ said Bill Fennell, chief ombudsman and managing director of the Motor Ombudsman.

A consumer ‘double-whammy’

Jayson Whittington, chief editor of Glass’s (part of Autovista Group) explained that the grant only really applied to a small number of models thanks to the price cap that was in place.

‘I think there is potentially a double-whammy for consumers, however, as it will result in them paying £1,500 more to buy one of the previously-qualifying BEVs, but the likelihood is it will also lead to OEMs no longer pricing models under the £32,000 threshold. Therefore, the price of some of the affected models will probably rise,’ he said.

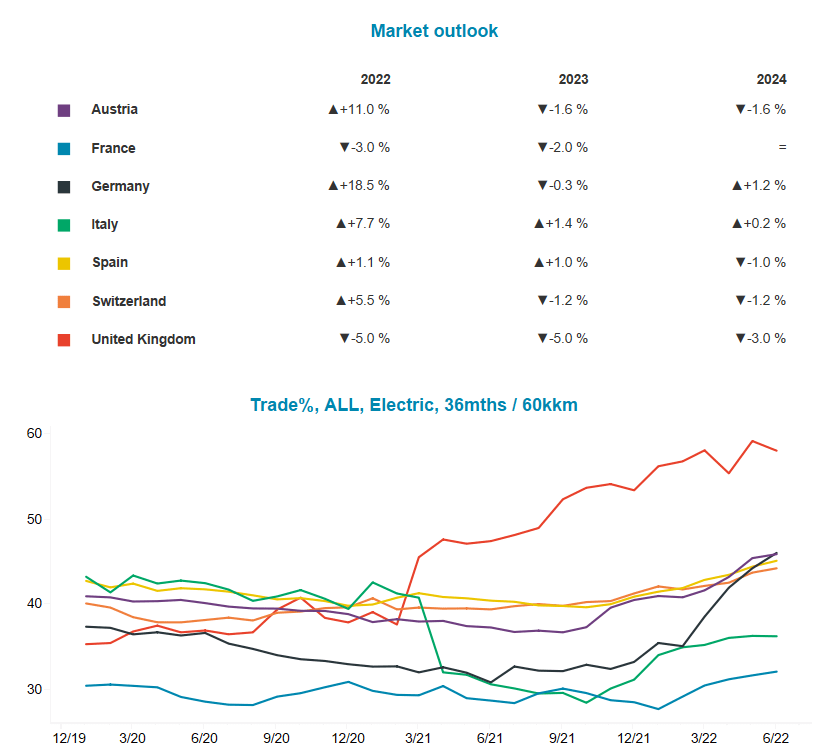

But what does all of this mean for BEV residual values? Average RVs across the UK have been declining, unlike other key European markets. But BEVs have remained a noticeable outlier, with residual values remaining strong on the back of ongoing international influences.

‘I do not foresee a significant change in the residual-value outlook, however, any small change would be positive, as the grant had the same effect as a discount,’ Whittington added.

BEV trade %RV and outlook, 36 months and 60,000km, January 2020 to June 2022

As in other major European markets, overall residual values across in the UK remain high. RVs did see strong growth in the second half of last year, but this should be thought of more as ‘overheating’, from which the market is now cooling.

However, higher BEV list prices will lead to a cascading effect down to the used-car market, which will be met with increased demand as a result. Given the continuing influence of COVID-19 and supply issues, exacerbated by the war in Ukraine, strong BEV RVs can be expected to endure. This more positive outlook contrasts sharply with other fuel types, where average residual values have taken a downwards turn.