Renault, Nissan, and Mitsubishi commit to common roadmap

28 January 2022

Renault, Nissan, and Mitsubishi have unveiled a joint 2030 roadmap to electric and connected mobility. This route requires a huge investment, with the companies committing a total of €23 billion over the next five years. These funds will support a raft of joint projects, which all the companies look to benefit from.

By 2030, the alliance will have 35 new electrically-chargeable vehicles (EVs), with 90% of these models based on five common platforms. This electric expansion will be bolstered by increased battery production, with the companies expecting to oversee 220GWh worth of capacity by the beginning of the next decade.

‘Smart differentiation’

The three carmakers have developed a ‘smart differentiation’ method. This sets the level of commonality between each vehicle and grants access to a pool of resources like platforms, production plants, and powertrains. However, this is reinforced with a strict approach to design and upper-body differentiation. So, the alliance’s common C and D-segment platform will support five models across three brands, including the Qashqai, X-Trail, Outlander, Austral and an upcoming SUV.

By 2026, the alliance will bolster its use of common platforms in its combined 90 models from 60% to 80%. Renault, Nissan, and Mitsubishi claim this will allow them to increase their focus on customer needs, the best models, and core markets. It will also allow each company to innovate more affordably during an increasingly expensive development period for the industry.

‘Today the alliance is accelerating to lead the mobility revolution and deliver more value to customers, our people, our shareholders and all our stakeholders,’ said Jean-Dominique Senard, chairman of the alliance. ‘The three member companies have defined a common roadmap towards 2030, sharing investments in future electrification and connectivity projects. These are massive investments that none of the three companies could make alone. Together, we are making the difference for a new and global sustainable future; the alliance becoming carbon-neutral by 2050.’

Ongoing investment

Alliance members have already invested some €10 billion into electrification. In Europe, Japan, the US, and China, 15 plants produce parts, motors, and batteries for 10 electric models. So far over one million EVs have been sold and 30 billion electric kilometres driven. Over the next five years, the three companies will invest more than €23 billion into electrification. By 2030, this will lead to 35 new electric models, 90% of which will share five common platforms.

This includes the affordable CMF-AEV platform, which underpins the new Dacia Spring. Meanwhile, the KEI-EV platform supports ultra-compact EVs. The LCV-EV Family platform is the base of the Renault Kangoo and Nissan Town Star. The global, flexible, modular CMF-EV platform will hit the road imminently, supporting the Nissan Ariya EV crossover and Renault Megane E-Tech Electric. By 2030, more than 15 models will sit on this platform, equating to 1.5 million cars produced every year. Reportedly providing up to 400km in range, the CMF-BEV platform will launch in 2024. It will support 250,000 vehicles a year across the Renault, Alpine and Nissan brands.

New market entrants

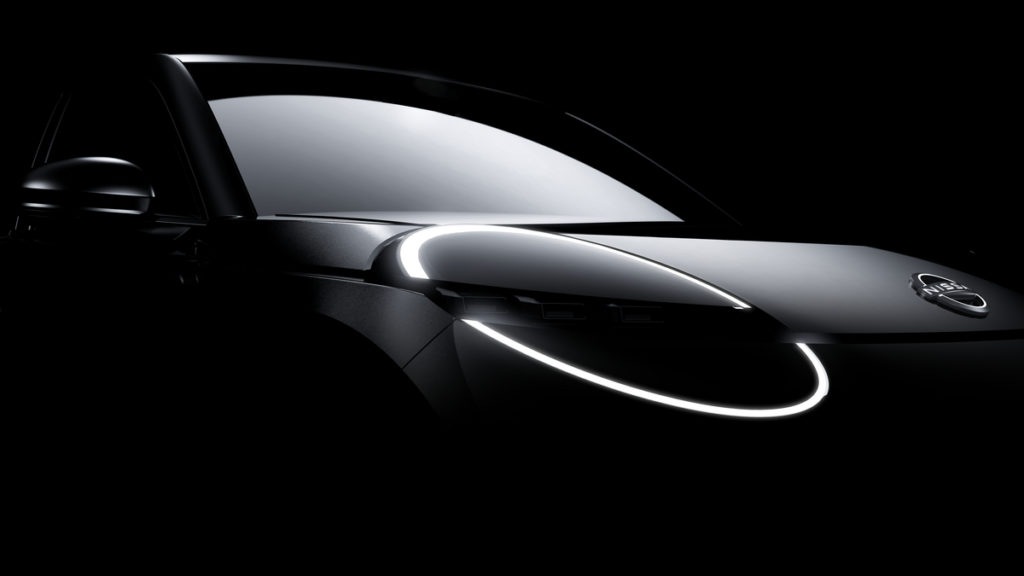

In Europe, Mitsubishi will launch two new vehicles, including the new ASX, which is based on popular Renault models. Meanwhile, Nissan will unleash a new all-electric compact car to take over from the Micra as the brand’s entry-level vehicle. It will be built on the CMF-BEV platform in the Renault ElectriCity centre in France.

‘This all-new model will be designed by Nissan and engineered and manufactured by Renault using our new common platform, maximising the use of our alliance assets while maintaining its Nissan-ness,’ said Nissan chief operating officer, Ashwani Gupta. ‘This is a great example of the alliance’s ’smart differentiation’ approach. Succeeding our iconic Micra, I am sure this new model will provide further excitement to our customers in Europe.’

Battery building and connected control

To meet new model deadlines, the carmakers need to build a lot of batteries. So, with 220GWh of global production capacity planned, the alliance will work with common partners to achieve the necessary scale and affordability. By 2026, it wants to cut battery costs in half and then 65% by 2028.

The companies also share a vision of all-solid-state battery technology (ASSB), which will be led by Nissan. It has the potential to double energy density compared to current liquid lithium-ion units, and to reduce charging time by a third. The goal is to achieve mass ASSB manufacturing by mid-2028. Eventually, the alliance wants to hit cost parity with internal-combustion engines (ICE), bringing costs down to $65 (€58) per kWh.

Elsewhere, the alliance wants to have 25 million cars connected to its cloud by 2026. This would mark an increase of over 730% compared to the 3 million cars connected today. The companies also want to lead the way in introducing the Google ecosystem into cars. Plus, members aim to equip over 10 million vehicles with autonomous-driving systems by 2026.

Renault is leading efforts to develop a common, centralised electrical architecture, which converges hardware and software. The alliance’s first fully software-defined car can be expected by 2025, which will improve throughout its life cycle, gaining performance updates over the air.