Swiss new-car registrations recover in September while used-car market takes another hit

20 October 2022

Hans-Peter Annen, head of valuations and insights at Eurotax Switzerland (part of Autovista Group), analyses how the Swiss new- and used-car markets are holding up.

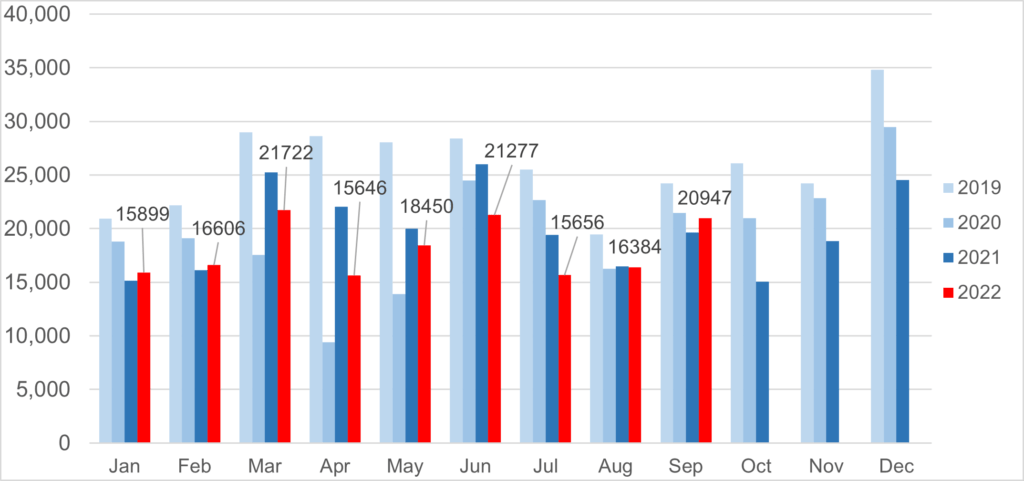

The poor spring and summer new-car registrations in Switzerland did not continue into September, which performed better than a year ago. However, the Ukraine war, supply-chain uncertainties, inflation, and the energy crisis are clouding the outlook for the final quarter of the year.

Last month, 20,947 new passenger cars were registered, up 6.6% year on year. But compared to 2019, new-car registrations were still down 13.5%. In total, the first three quarters saw a significant year-on-year drop of 9.7% (down 28.2% versus 2019). No significant improvement is in sight for the rest of the year, due to the uncertain COVID-19 situation in China.

New-car registrations by month: 2019-2022

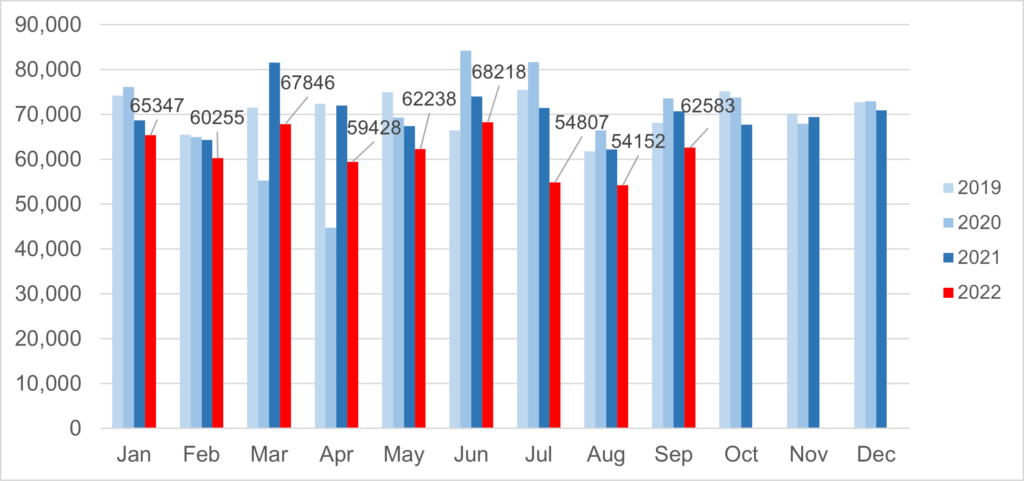

The used-car market, on the other hand, had been on an upward trend since the summer months of 2020, underpinned by stable demand and low supply. In 2021, used-car transactions inched up by 1.1% to 840,044, almost reaching the pre-pandemic levels seen in 2019.

However, it is worth noting that supply is on the increase again. Furthermore, in the first half of 2022, the volume of ownership changes took a strong hit and was 8.5% below the previous year’s figure – according to the previously used counting method (please see note below). The volumes for the third quarter, according to the new counting method, are even lower than in the previous year, but are no longer directly comparable. The upward trend has therefore been broken in 2022.

The trend towards declining changes of ownership is likely to continue as long as new-car registrations remain low and fears of a recession are now also being felt.

Used-car transactions by month: 2019-2022

*Note on 2022 figures: Since the beginning of 2022, the Federal Roads Office ASTRA has provided figures for changes of ownership. Before that, up to and including June 2022, ASTRA supplied raw data with all changes in the Swiss vehicle stock. The analysis of changes of ownership was carried out by Eurotax, partly with assumptions. The figures calculated in this way were approximately 3% higher than the values according to ASTRA’s own new evaluation from 2022 onwards. For this reason, figures for 2022 based on these ASTRA data are displayed. The values up to and including 2021 are shown according to the previous method. When comparing the figures for 2022 with previous years, this must be taken into account. Comparisons are therefore only possible to a very limited extent, if at all.

Although the number of used cars on offer has recovered steadily in recent months, the available volume is still around 15% lower than in pre-pandemic February 2020. Prices for diesel and petrol models have benefited particularly from this shortage. Plug-in hybrids (PHEVs) and, above all, full-hybrid electric vehicles (HEVs) were also able to make gains, albeit to a lesser extent.

Still, the price trend is slightly down. Battery-electric vehicles (BEVs) are struggling to return to 2020 levels across all age groups. However, the younger models are an exception: among 12-month-old cars, BEVs even take the first place in terms of residual-value (RV) retention, with an average trade value of 70.5% of their original list price in September.

With lockdowns and factory closures recurring as seen in China, the war in Ukraine leading to high inflation and exorbitant energy costs, and supply chains still disrupted, new-car sales are also unable to recover significantly. This, despite a slight recovery, continues to affect the supply situation and prices of used cars. The price increase for used cars is flattening out or declining slightly, but at a high level.

Comparing the supply situation to consumer sentiment and demand is crucial to understand the future development of the used-car market. Only if demand for used cars drops significantly due to the gloomy economic outlook and supply fears, are residual values likely to come under pressure. Meanwhile, RVs will remain at a high level.