Are tides changing for Poland’s new and used-car markets?

14 November 2022

Poland’s new and used-car markets have seen demand far exceed supply in recent years. But Marcin Kardas, head of valuations at Eurotax Poland (part of Autovista Group), explains why things might be about to change.

The last two years have painted a stormy picture of the automotive market, not only in Poland but across Europe. Demand for new cars far outstripped supply as manufacturers struggled to cope with the effects of the pandemic, namely supply disruptions and rising component prices.

Reduced new-car registrations triggered an increase in residual values (RVs). This affected younger models first, then older cars. The sharp rise in prices, combined with jeopardised consumer purchasing power, has gradually driven interest towards smaller and older cars. This trend will likely continue until manufacturers get to grips with production problems.

Turn for the worse

In the second half of 2022, the economic situation in Poland has taken a turn for the worse. This has heavily impacted demand, which has not died down to zero but is prolonging the sale of used vehicles.

On one hand, new-car prices keep rising rapidly. Although supply is gradually improving, this mainly applies to standard-equipped cars. For individually configured vehicles, there is still a wait of up to several months. On the other hand, high-interest rates have significantly increased the cost of financing purchases. In this environment, demand problems have arisen, and used-car prices have stopped rising.

The scale of this phenomenon varies depending on the source of the vehicle. In dealer networks, it is not yet noticeable enough to lead to price reductions. But non-network companies have already begun adjusting prices to stimulate demand.

It is important to remember that vehicles are entering the used-car market much later and with higher mileages than before the pandemic. This is due to the extension of the lease/usage period as new replacement vehicles are in short supply.

The slowdown in asking-price growth amid market volatility is statistically observable. Poland is not alone in this situation since the German market is reacting similarly.

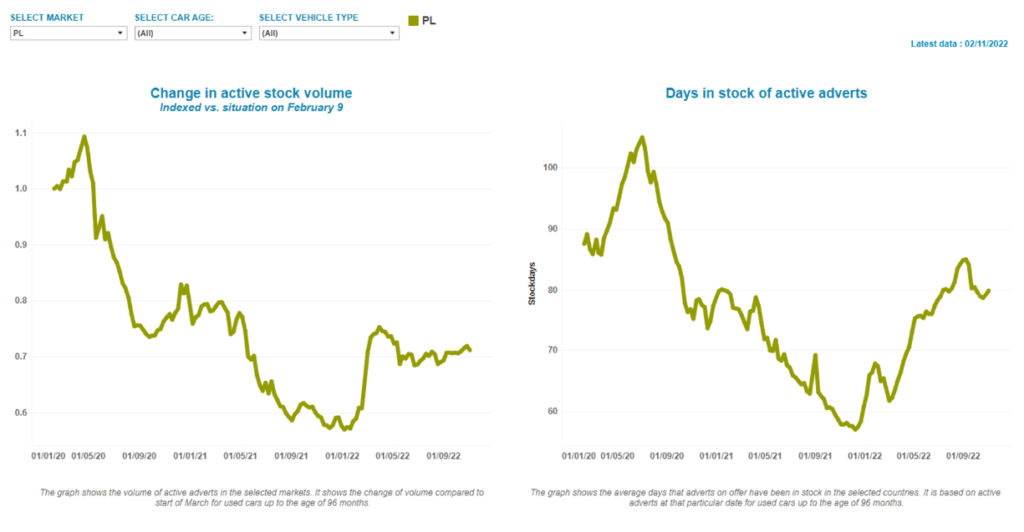

Despite slowly improving supply, used-car stocks remain limited in Poland, at about 70% of pre-pandemic levels, but the time it takes to sell a used car is clearly increasing.

Market volatility

The coming months will be decisive in establishing whether the market has finally reached a turning point, with used-car values falling again. The volatile situation exists in virtually all market segments, including cars, vans and trucks.

The commercial-vehicle sector is particularly sensitive to the economic situation in Poland and across Europe, with current forecasts effectively reducing the inclination to invest. There is a clear decline in new-vehicle orders, although this is linked to production capacity and long delivery times.

Data published by PZPM revealed that new-car registrations up to and including October reached 378,534 units in Poland. This is down 7.9% on the same period last year. Vans also saw a decline, falling 15.7% (60,472 units). Under current conditions, it is difficult to determine whether this reflects a drop in demand or ongoing issues with supply. Over time, the willingness to buy will likely decrease due to economic uncertainty. On the other hand, the availability of cars is clearly improving month by month.

In the case of trucks, there has been a 5.5% year-on-year increase in registrations (26,176 units). This is certainly a realisation of past orders, stretching back from even a year ago. However, the market is already seeing a marked decline in new orders, accompanied by fears over the projected economic crisis. LNG-powered cars have been particularly affected, due to increasing fuel prices.

For now, it is difficult to predict potential market developments in Poland. There are too many volatile variables, primarily linked to the ability to finance purchases, impacting demand. Therefore, it is worth considering a more conservative approach to residual values – that have already reached extremely high levels – and preparing for considerable market volatility.