UK new-car market begins 2023 with growth deceleration

08 February 2023

UK new-car registrations enjoyed their sixth consecutive month of year-on-year growth in January 2023. The market has weakened slightly however, in line with Autovista24’s expectations, explains senior data journalist Neil King.

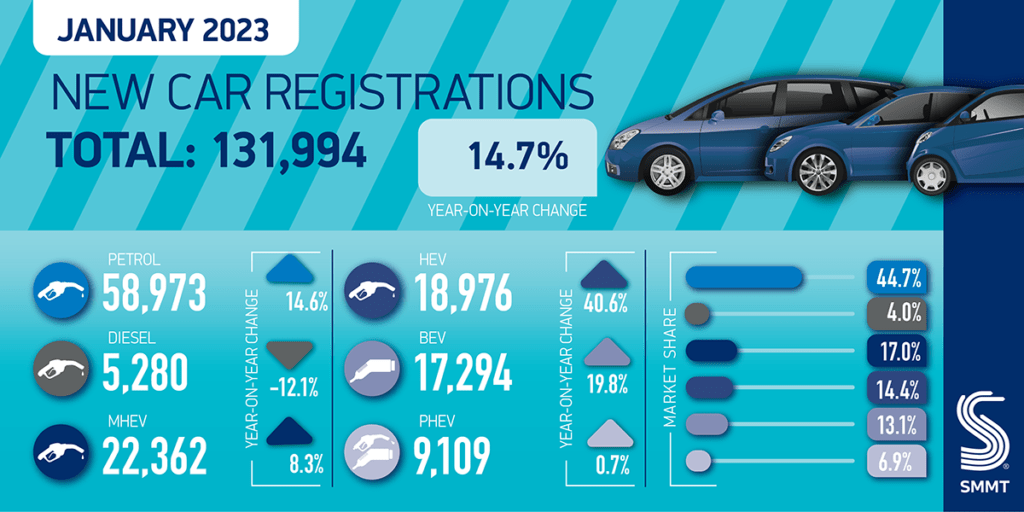

The Society of Motor Manufacturers and Traders (SMMT) reports that new-car registrations in the UK increased 14.7% year on year last month, to 131,994 units. This aligns with Autovista24’s forecast of 130,000 registrations but represents the weakest growth rate since September 2022, despite there being one more working day than in January 2022.

Adjusted for working days, Autovista24 calculates that the market grew 9.2% year on year, following double-digit gains in the last three months of 2022. The seasonally-adjusted annualised rate (SAAR) receded to 1.9 million units from 2.12 million units in December. Nevertheless, the SMMT emphasises that ‘this was the best start to the year since January 2020’s pre-COVID 149,279 units.’

‘The automotive industry is already delivering growth that bucks the national trend and is poised, with the right framework, to accelerate the decarbonisation of the UK economy. The industry and market are in transition, but fragile due to a challenging economic outlook, rising living costs and consumer anxiety over new technology. We look to a budget that will reaffirm the commitment to net zero and provide measures that drive green growth for the sector and the nation,’ commented SMMT chief executive Mike Hawes.

‘Countercyclical’ market

The consumer prices index (CPI) receded slightly to 10.5% in the 12 months to December but inflation remains a persistent issue in the UK. Furthermore, the Bank of England increased interest rates by a further 0.5% to 4% on 1 February, only weeks after hiking them by 0.5% on 14 December. The financial institution foresees the bank rate rising to around 4.5% in mid-2023 and falling back to just over 3.25% in three years’ time.

Compounding high inflation and rising interest rates, the average energy price cap will increase from £2,500 (€2,900) to £4,500 (€5,220) from April 2023, and unemployment is expected to rise too. There are grounds for cautious economic optimism, with the Bank of England stating that it ‘now expected GDP to have grown by 0.1% in 2022 Q4 as a whole, stronger than at the time of the November report.’

However, the cost-of-living crisis shows no sign of abating in the short term and although the supply bottlenecks in the automotive industry continue to ease, the semiconductor shortage is unlikely to disappear in 2023.

Although the UK’s new-car market is performing in line with Autovista24’s expectations, the outlook remains particularly uncertain. Against the backdrop of persistent inflation and expected rises in interest rates and energy prices, Autovista24 has reduced its 2023 forecast by 15,000 units to 1.81 million, equating to growth of 12.4%. This would be 21.5% lower than in 2019.

The SMMT echoed this sentiment in its February outlook, which is slightly more pessimistic than Autovista24 as it anticipates 1.79 million new car registrations in 2023, an 11.1% increase on the past year.

‘The latest market outlook was set against a weaker economic backdrop as households and businesses continue to come under intense pressure from the cost-of-living crisis from high inflation. However, with supply chain issues holding back past market volumes, we expect the market to be countercyclical in 2023 and show growth, ahead of further recovery in 2024,’ the association commented.

The downside of recovering supply is that new-car registrations will be less bolstered by fulfilling a backlog of orders. Furthermore, new-car demand will continue to suffer from weak consumer confidence, high interest rates and inflation. Accordingly, Autovista24 has also reduced its forecasts for 2024 and 2025 by about 15,000 units each year but still forecasts respective year-on-year growth of 4.8% and 1.1%.

Narrow gap between diesels and PHEVs

The SMMT highlighted that ‘electrified vehicles notably drove the increase [last month], as manufacturers continue to bring ever more choice to the market despite ongoing strains on the supply chains.’

Registrations of new battery-electric vehicles (BEVs) increased 19.8% year on year to reach 17,294 units, although their 13.1% share was slightly below the 16.6% achieved in full-year 2022. Plug-in hybrids (PHEVs) only gained 0.7%, with their share falling to 6.9%, replicating the downward trend across Europe.

Nevertheless, the gap in share between PHEVs and diesel cars (including mild-hybrid diesels) has narrowed to just one percentage point and the SMMT notes that ‘one in five new cars registered in the month came with a plug.’

Hybrid-electric vehicles (HEVs) recorded the healthiest year-on-year growth of all fuel types, at 40.6%, and comprised 14.4% of new-car registrations last month. Accordingly, one in three new cars registered in the UK houses an electrified powertrain.

Charging infrastructure ‘failing to keep pace’

The SMMT forecasts that electric vehicles (EVs) will account for more than one in four new-car registrations in the UK this year, gaining 32.1% to 487,140 units, and will capture almost a third of the market (31%) in 2024, with 607,150 units. These predictions align with EV-volumes.com, which forecasts that the EV share will rise to 27.1% and 33.8% in 2023 and 2024, respectively. However, the SMMT cautioned that ‘the rollout of infrastructure needed to charge them is failing to keep pace.’

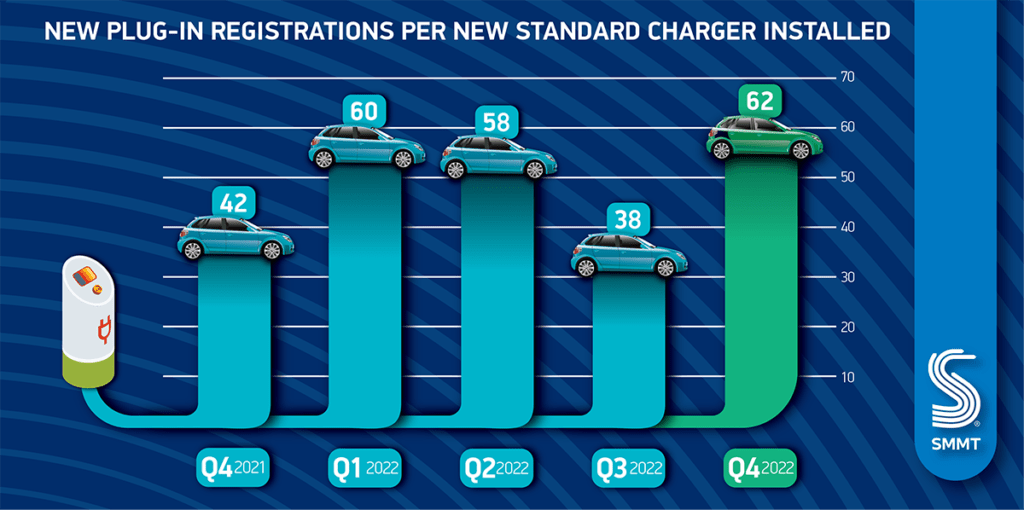

‘During Q4 2022, the ratio of new charge-point installations to new plug-in car registrations dropped to one for every 62 – a significant fall compared with the same quarter last year, when the ratio was 1:42. As a result, in 2022, one standard public charger was installed for every 53 new plug-in cars registered, the weakest ratio since 2020. Mandating rollout targets for infrastructure and regulating service standards would give drivers certainty they can always find a working, available charger. Infrastructure must be built ahead of demand else poor provision risks delaying the electric transition,’ the association explained.

Furthermore, as the share of new cars powered by internal-combustion engines (ICE) falls, governments need to address the shortfall in their finances by not only reducing incentives for EVs but also taxing them.

In July 2022, Switzerland outlined plans to tax EVs and in its 2022 autumn statement, the UK government announced that EVs will no longer be exempt from vehicle excise duty from 1 April 2025. ‘This will ensure that all road users begin to pay a fair tax contribution as the take-up of electric vehicles continues to accelerate.’

The SMMT is calling on the UK government to ‘review proposals to graft a vehicle excise duty regime designed for fossil-fuel cars onto zero-emission vehicles (ZEVs).’

‘The higher production costs associated with electric vehicles means that currently more than half of all available BEVs would be subject to the expensive car supplement due to apply to ZEVs from 2025. While it is right that all drivers pay their fair share, existing plans would unfairly penalise those making the switch, and risk disincentivising the market at the time when EV uptake should be encouraged,’ the association concluded.