Climbing new-car list prices add to used-car supply woes in Austria

25 October 2022

Headlines continue to paint a sobering picture of Europe’s automotive markets. Carmakers are still grappling with disrupted supply chains, not least when it comes to semiconductors. List prices for new cars are on the increase, with rising energy costs and inflation impacting consumer demand.

Eurotax Austria (part of Autovista Group) addressed these and other trends in its latest webinar, with Robert Madas (regional head of valuations, Austria, Poland, Switzerland), and market analysts Emma Abid and Rainer Hintermayer. The trio took a deep dive into the developments seen across Austria’s new- and used-car markets.

Weak new-car market

As elsewhere in Europe, prices for new cars have increased in the country, Madas noted. But this is not solely due to surging inflation, which reached around 11% in September. Emissions standards, the standard fuel-consumption tax (NoVA), as well as a more diverse product portfolio and advanced equipment, are all influencing new-car list prices. In Austria, these have grown by 20% on average since the beginning of 2019, with models in the lower-price segments seeing particularly steep increases.

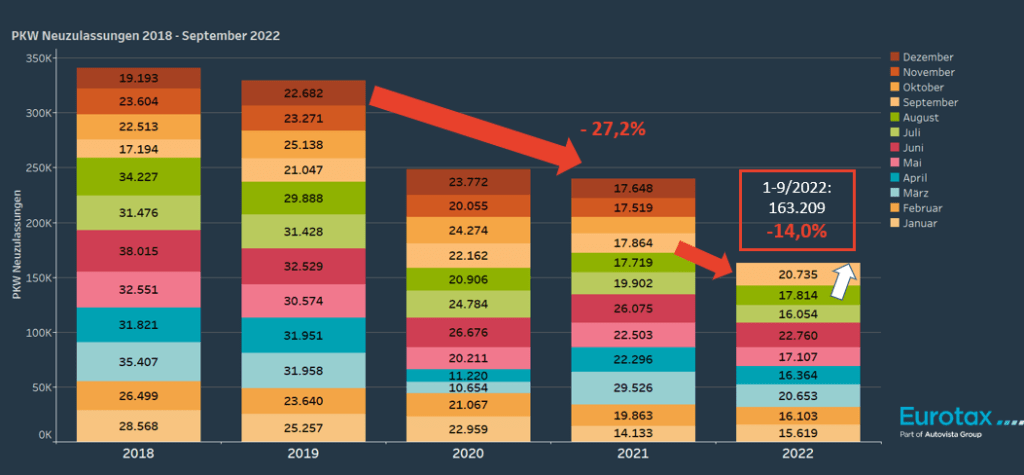

Meanwhile, new-car registrations in 2022 have once again been weaker than in previous years, with the war in Ukraine clearly affecting the Austrian market. Put into context, 2020 proved to be the weakest year for new-car registrations in over three decades, with 2021 recording a further decline due to the chip crunch.

In the first nine months of 2022, new-car registrations dropped by 14% year on year, reaching a total of 163,209 units. However, in August and September, registrations grew. September recorded a 16% increase, with 20,735 newly registered passenger cars.

New-car registrations in Austria, 2018 to September 2022

One trend emerging from the analysis of Austria’s registration data is the poor performance of light-commercial vehicles (LCVs). New LCV registrations are down considerably, with monthly sales in 2022 often falling below 2,000 units.

Hintermayer also highlighted the growing popularity of electromobility in the new-car market. The share of battery-electric vehicles (BEVs) reached nearly 15% during the first nine months of this year. The total market share of electric vehicles (EVs) – including hybrids – was 25.7% in the period. Some of the country’s most popular electric models include the Renault Zoe, the Tesla Model Y, and the Cupra Born.

While the share of company cars among newly-registered BEVs is slowly decreasing – from 75.9% in the first nine months of 2021 to 70.9% in the same period in 2022 – electromobility is gaining momentum among private customers. Around 29% of new BEVs were registered by private customers from January to September 2022, up from 24.8% a year ago.

The reasons for this include the increasing variety of models as well as cost parity. ‘With the current rise in fuel costs by about 50%, this further favours the total cost of ownership (TCO) calculation for electric vehicles,’ Hintermayer said.

Lack of used cars

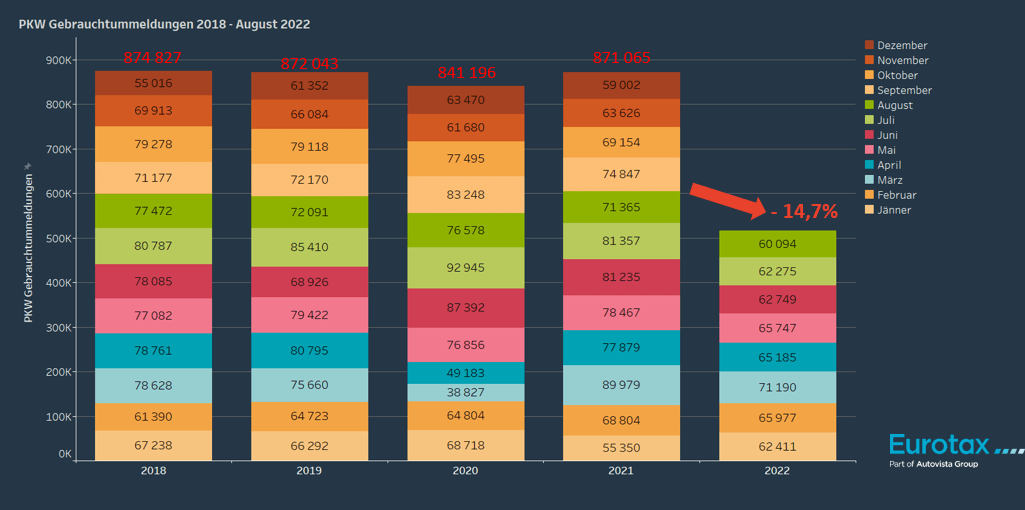

Looking at used cars, the year had a good start in January and February, but the market environment has since changed. From January to August 2022, around 515,000 used cars changed ownership in Austria, down from 604,000 in the same period in 2021 – a sharp fall of 14.7%. Abid explained that this is largely due to the lack of supply and huge increases in used-car prices.

‘2022 is so far significantly below the previous year, young used cars in particular are missing due to weak new-car registrations since 2020,’ she said.

Used-car transactions in Austria, 2018 to August 2022

Diesel still dominates the used-car market with a share of more than 50%. But EVs, including hybrids, are growing in importance too, reaching a share of 4.4% in the first eight months of 2022, up from 3.1% in 2021. Similar to the new-car market, SUVs are getting more popular as used-car transactions in this segment are on the uptick.

Overall, the market for used cars has thinned out as supply has fallen by around 25% since the beginning of 2020, despite a recent upward trend. Meanwhile, the number of days used cars spend in stock, i.e. listed actively online, has remained stable. On average, a used car is listed online for 85 days, and there are currently around 100,000 used passenger cars on offer.

Residual values

New- and used-car market developments are also impacting residual values (RVs). Demand for cars is gradually decreasing while supply is slowly improving. Madas pointed out the long delivery times for new cars, with fewer new vehicles available due to the current market environment.

Offer prices have increased since the second half of 2021, especially for older vehicles – those aged above 54 months. Madas emphasised that offer prices are up 20% compared to February 2020. RVs are currently the highest for young BEVs aged up to 12 months at 68.5% in trade value, Madas said. But RVs for 36-month-old diesel cars and plug-in hybrid vehicles (PHEVs) are also high at 54.9% and 55.7% respectively.

‘By the end of 2022, we expect residual values to rise for all fuel types. For 2023, we expect pressure on residual values and at least a slight decline,’ Madas said. He cautioned that forecasts are much more difficult to make due to the current market environment.

‘A look at the current forecast values of comparable petrol, diesel, and electric models shows that the current generation of EVs can usually keep up with their internal-combustion engine counterparts,’ Madas said.

This is particularly true for EVs with relatively low annual mileages, such as 15,000km a year. Considering cars with higher mileages – such as 30,000km a year – diesel models are more stable in value than comparable petrol, PHEV and BEV models.

Find the full slide deck for the presentation (in German) below