What to know about electric-vehicle remarketing

19 December 2022

Electric vehicles (EVs) require a fresh approach to remarketing, explain Dr Christof Engelskirchen, chief economist of Autovista Group, and Roland Irle, EV-volumes.com co-founder and developer.

While the remarketing of EVs is in its infancy, every corporate and vehicle-leasing provider must prepare for a future in which it features prominently as the European EV parc expands.

The dearth of car supply, EVs in particular, may be a blessing for those holding asset risks as it has slowed the build-up of to-be-remarketed volumes. From a portfolio perspective, electrification is diversifying the asset base of leasing companies and fleets – and that is a positive.

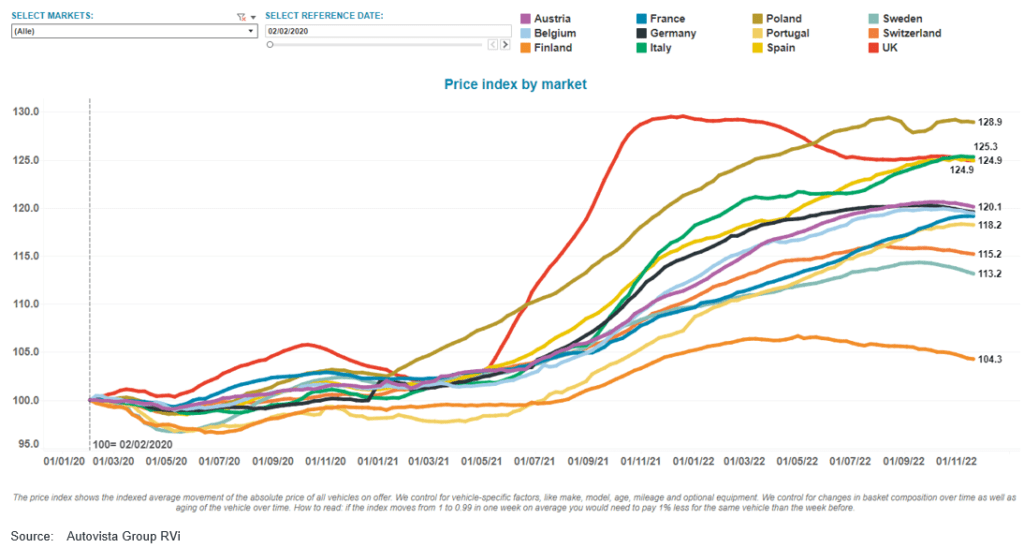

The leasing industry benefitted from the substantial rise in residual values (RVs) during the COVID-19 pandemic, a trend which has only recently been coming to an end. This did not translate into lower leasing rates, however. Therein lies a big systemic challenge: anticipating the correct RV forecast for cars registered during 2022 and 2023, in light of an expected downward moderation of prices across fuel types.

Used-vehicle price index by market across Europe, February 2020 to November 2022

No industry standard

Battery-electric vehicles (BEVs) require additional data points for remarketing, especially regarding battery health. But, there is no industry standard as of yet. Most models feature an eight-year battery warranty, which limits exposure during the first remarketing transaction.

The remarketing of an EV will require additional test drives and thorough assessment by the next potential owner, especially within a retail context. This may be challenging for a direct online used-car remarketing channel when they do not accommodate test-drive opportunities.

Specialised remarketing centres for BEVs and plug-in hybrids (PHEVs) could add value, as additional services and warranties could be sold.

Assessing China‘s EV influence

Currently, most EVs produced in China for European markets come from Western brands like Tesla, Volvo, Polestar, Renault, Dacia and BMW. Among Chinese OEMs, SAIC’s MG brand is the most active in Europe. Some of the Chinese brands with European ambitions are powerhouses with substantial market shares like BYD, which sells more EVs worldwide than Tesla (PHEVs included).

These companies know how to build and sell cars and have been closely analysing the success of Hyundai and Kia in Europe. Additionally, they can bypass supply issues suffered by European brands, especially for batteries. These OEMs also have lower energy costs, making their products very competitive.

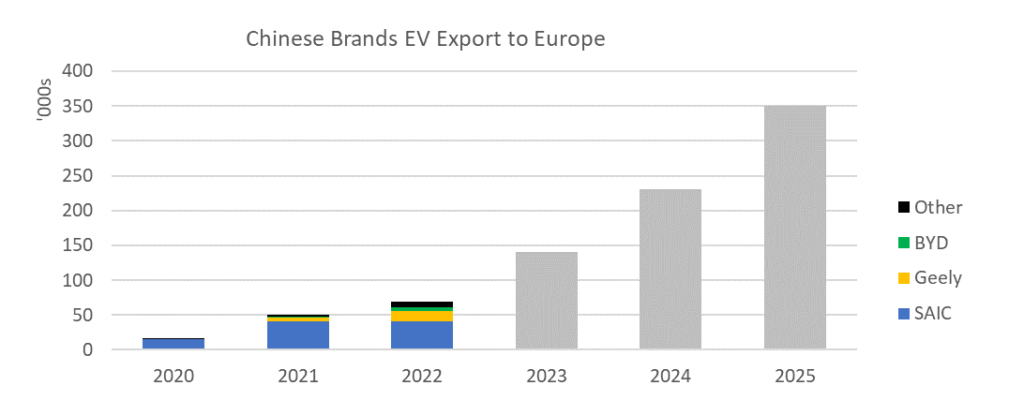

Chinese brands can be expected to start an export offensive when their capacity exceeds domestic demand. SAIC, BYD, and Geely are likely to be the most prominent players. Total exports of Chinese brands’ EVs are forecast to increase from 70,000 in 2022 to 350,000 in 2025. EV-volumes.com expects these companies will increase their share in the EV sector from 2.8% today to 5% in 2025.

Chinese brands EV exports to Europe, 2022 to 2025

For fleets, these brands represent an opportunity to do more business, especially while the supply of European models remains constrained.

For remarketing, they represent a challenge in terms of establishing fair, but realistic RVs. EV-volumes.com data show that association with a strong and established European brand, such as Polestar’s association with Volvo, or Ioniq’s association with Hyundai, has a substantially positive impact on remarketing performance.

It is no surprise that the remarketing of EVs requires a different approach compared to traditional internal-combustion engine (ICE) powertrains. This is not just at a business level but also a practical one. Potential buyers need more time for testing and all the paperwork must be watertight. But these challenges can also be considered opportunities to add value for those remarketing.

Tips for remarketing EVs

- Anticipate more extensive testing and slightly longer times to sell in a retail environment

- Ensure vehicle documentation is exhaustive and enables cross-border remarketing

- Get ready for battery-health certification

- Review RV forecasts regularly in light of newly forming market pressures. Furthermore, ensure that lifecycle depreciation is assessed realistically at the time of purchase. It is still higher than for ICE models

- Many new players can be expected to enter the market in the coming years. Their price positioning and vehicle capabilities around connectivity and range will impact existing EV portfolios of fleet and leasing companies

- When it comes to in-fleeting new-Asian brands, Autovista Group data show that association with a strong and established OEM improves RV performance. This should be considered when establishing RV forecasts.