What are the best cars to buy in Germany that keep their value?

18 July 2022

There is no better way to assess the performance of a car than looking at how well it retains its value. Dr Christof Engelskirchen, chief economist of Autovista Group, and Andreas Geilenbrügge, head of insights at Schwacke, rank Germany’s best cars to buy and tell you why the vehicles make the grade.

Reviewing more than 50,000 different vehicle variations of more than 1,000 model series available, there were some surprises – a van dominates the car ranking and electric vehicles are not found in the top half of the list and need their own performance category to compete.

‘Vans have benefitted a lot from rising demand during and following the COVID-19 pandemic,’ said Engelskirchen, and ‘small and micro cars have become increasingly expensive to build due to emissions regulation but represent economic and affordable mobility for individuals. Their residual values have also benefitted a lot during the past two years and we expect this to continue.’

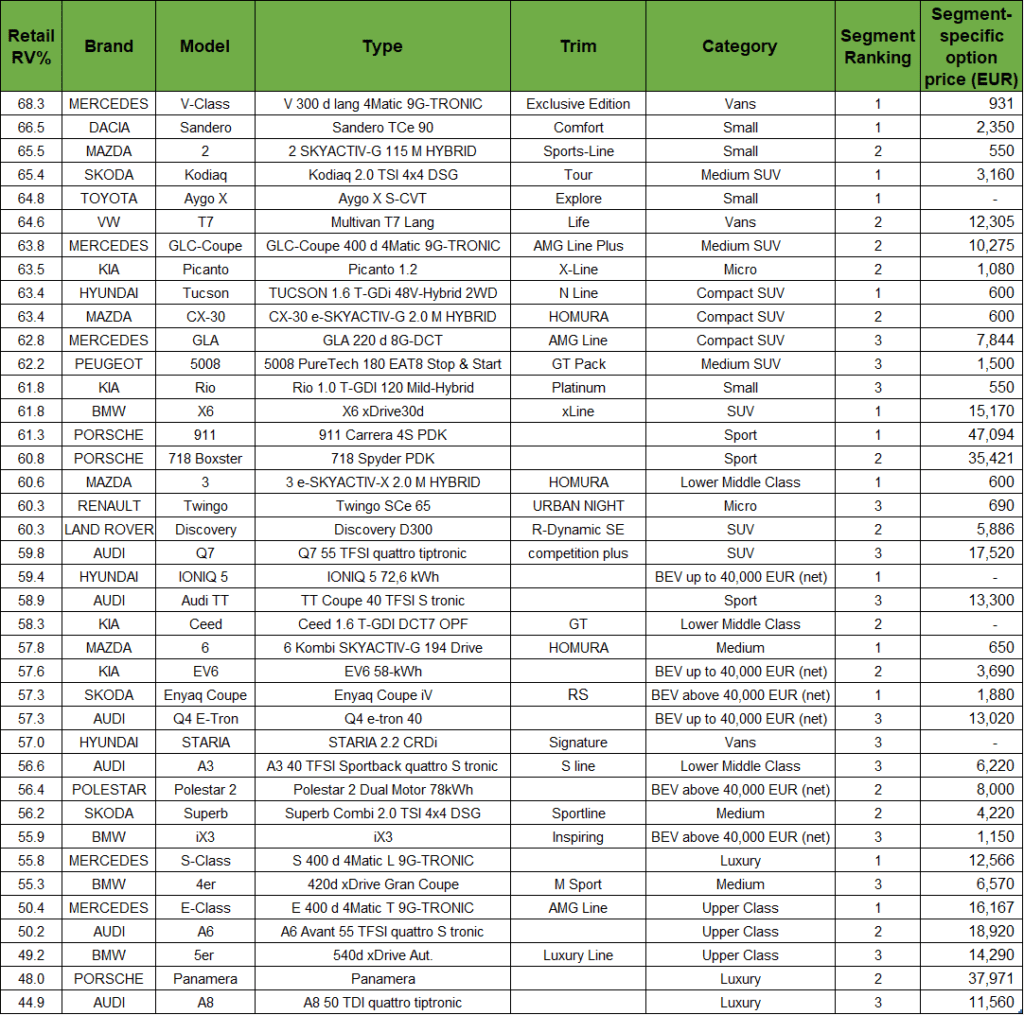

The best car to buy, based on future residual-value (RV) performance by looking at May 2022 Autovista Group data, is the Mercedes-Benz V-Class 300d 4Matic 9G-Tronic Exclusive Edition. The table below shows which cars are best at retaining their value – these are Germany’s best cars to buy.

Germany’s overall best cars to buy (passenger cars)

Note: Ranked by relative future residual-value performance at 48 months of age, considering segment-typical mileage and equipment levels; forecast from May 2022.

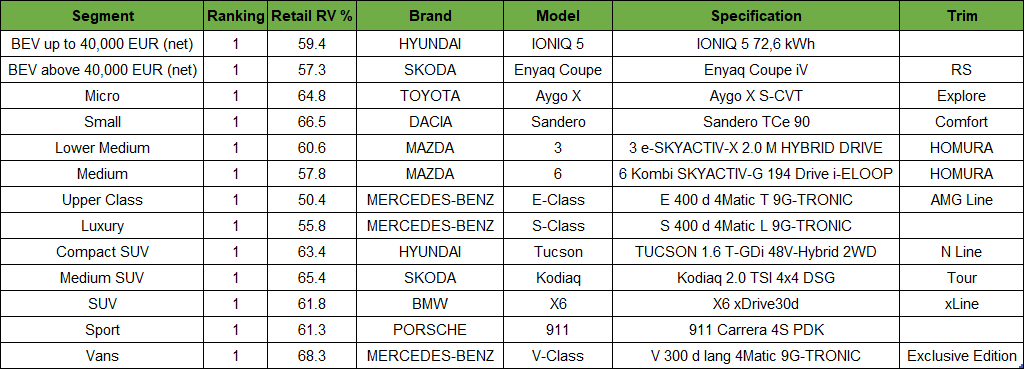

BEVs still need time to bed in

Battery-electric vehicles (BEVs) will dominate our future and may already be crucial in the current mix of cars. For the time being, they require their own categories to gain visibility in this ranking; they do not rank in the top half of the listing.

BEVs made up two distinct categories in the overall 13 categories that were assessed, based on net-entry list price, without optional equipment: those above €40,000 and BEVs below €40,000.

They may only populate the lower half of the ranking, but still perform better than many would have thought only a year ago. The attractively priced Hyundai Ioniq 5 (59.4% future retail value after 48 months, with segment-typical equipment and mileage) leads the pack.

The Kia EV6 and the Skoda Enyaq Coupe perform similarly to the Audi Q4 e-Tron at around 57.5%. The Polestar 2 and BMW iX3 are close at 56.4% and 55.9%, respectively. These are remarkable results overall, considering the relatively higher list-price positioning of BEV over an internal-combustion-engine vehicle and the abundant incentives offered on Germany’s new-car market.

SUVs outranked

When looking for excellent value retention, SUVs used to be a safe bet. Today, the SUV segments have become more populated and competitive. They still perform well in terms of value retention –all SUV contenders are in the top half of the ranking. But only one SUV makes it into the top six of our best-car buys: the Skoda Kodiaq. Five of the top six places are taken up by two vans (Mercedes V-Class; VW T7), two small cars (Dacia Sandero; Mazda 2) and Toyota’s Aygo X.

VW’s performance surprises. After a total of five top-three rankings in 2021, the brand from Wolfsburg is only represented once in the 2022 best cars to buy ranking and comes in second in the van segment (Multivan T7). The most-frequently represented brand in the 2022 rankings is Audi, with six placements.

Tesla does not show in this year’s best-buys ranking, after being ranked first and third in the two BEV categories a year ago. Its models are still performing well on used-car markets, but competition has been catching on and Tesla models are aging. Lifecycle depreciation is particularly strong in the BEV segments, with rising ranges and a constant influx of competitive models and brands. Polestar is one of these brands and is represented in the rankings for the first time.

‘It is important to point out that there are substantial residual-value differences between segments’, noted Geilenbrügge. ‘Therefore, we assess each segment independently before selecting the top three performers by segment’. In other words, you will find high-RV cars in the small-vehicle segment, which would outperform the luxury-vehicle segment in terms of relative value retention. But if they have not made the top three in their segment, they are not on the list of Germany’s best cars to buy.

Mercedes dominates

Mercedes demonstrates that premium still matters, dominating the ranking in the prestigious luxury, upper-class, and van segments. It does not appear at all in the BEV rankings, though, hinting at them lagging a bit behind competitors in terms of electrification strategy.

Hyundai and Skoda are competitive in the ranking – they both can claim two best buys: one for the best BEV and one for the best SUV. Skoda dominates the slightly larger two segments, BEVs above €40,000 and Medium SUVs. Hyundai is the best-car buy in the smaller of the two segments: BEVs below €40,000 and Compact SUVs.

Germany’s best cars to buy by segment (passenger cars)

Note: Ranked by relative future residual-value performance at 48 months of age, considering segment-typical mileage and equipment levels; forecast from May 2022.

Forecasts higher than usual

Overall, RV forecasts are much higher than is typically seen in Germany – across segments. The main reason is supply disruption that has been going on for over two years now.

‘In light of the current supply shortage, nearly every used car looks like a residual-value champion,’ commented Geilenbrügge. ‘But there are differences in used-car market performance that are costly to ignore for those holding the asset risk.”

And that asset risk is rising, considering that more than half of all new vehicles and more than two thirds of electric vehicles will come back to the used-car market in three-to-four years, due to the rising share of leasing and PCP-type financing arrangements.

The best-buys ranking reveals some further decisive characteristics in the line-up.

The column titled ‘segment-specific option price’ in the overall best-car-buys table often features no, or relatively low, values. Sometimes the value shown merely reflects the price for metallic paint. Low values in that column always mean that this vehicle’s standard equipment meets the demand of nearly all future potential used-car buyers, which supports a better RV performance, especially when cleverly packaged and priced.

Furthermore, when assessing the value of a car, better equipped trim lines and in particular the sporty ‘lines’, such as Sports-Line, S line, R-Dynamic, outperform other trims. Keeping that in mind will help OEMs optimise their price and specification strategies for an improved positioning in future league tables.