Europe’s big five new-car market outlooks stabilise as Ukraine war disruption dissipates

27 May 2022

As the impact of the Ukraine war on Europe’s big five new-car markets subsides, Autovista24 made only modest adjustments to its forecasts in May, senior data journalist Neil King explains.

Western Europe’s major new-car markets endured double-digit declines in April as the war in Ukraine continued to disrupt supply chains and delay vehicle deliveries. However, the downturns were less severe than in March, albeit only when adjusted for working days in all countries except Spain. Italy was in line with expectations and the slightly weaker-than-expected results in France and Germany were almost balanced out by strong performances in Spain and the UK.

Autovista24 assumes that the impact caused by the Ukraine war is lessening as alternative sources of raw materials and parts are secured. Following the disruption caused to manufacturers such as the BMW and Volkswagen (VW) groups, there have been no major additional production stoppages announced over the last month and the supply situation has improved.

Skoda, for example, has resumed production of its all-electric SUV, the Enyaq iV, at its Mladá Boleslav factory in the Czech Republic. This follows several weeks of manufacturing downtime caused by supply bottlenecks because of the war in Ukraine, leading to a shortage of wiring harnesses. Similarly, VW has restarted electric-vehicle manufacturing at its afflicted Zwickau plant and extended production of the ID.4 to a second plant in Germany, Emden, on 20 May.

Subtle amendments to 2022 forecast

As the April new-car registration figures were closely aligned with Autovista24’s assumptions and, moreover, yielded no further shocks, the volume forecasts for May and June have only been subtly amended. Although pre-existing supply challenges will continue throughout 2022,and could even persist until 2024, the outlook for the second half of the year has been broadly maintained too.

Overall, the combined 2022 forecast volume for the big five European markets has been modestly reduced from 8.35 million units last month, to 8.31 million units. This marks a reduction of just 33,000 units, or a 0.4% downgrade. Nevertheless, this latest outlook calls for year-on-year growth of only 0.8% in 2022 after two consecutive annual contractions of 25.4% and 2.2%. Compared to the February update, prepared prior to Russia’s invasion of Ukraine, the 2022 outlook for new-car registrations is about 620,000 units lower.

The new-car markets of France, Spain and Italy are forecast to contract between 2% and 4% in 2022. Autovista24 now expects 2.73 million new-car registrations in Germany this year, an increase of 4.3% year on year, but this follows a 10% downturn in 2021. The forecast for the UK has been subtly reduced to below 1.73 million units, representing year-on-year growth of 4.8%.

Significant downside risks remain, however, as BMW cautioned in its quarterly statement to 31 March. ‘If production interruptions continue throughout the remainder of 2022 and therefore have a significant impact on deliveries, a downward revision of the Group’s outlook cannot be ruled out. Any additional negative impact on global supply chains could also have similar consequences,’ the carmaker noted.

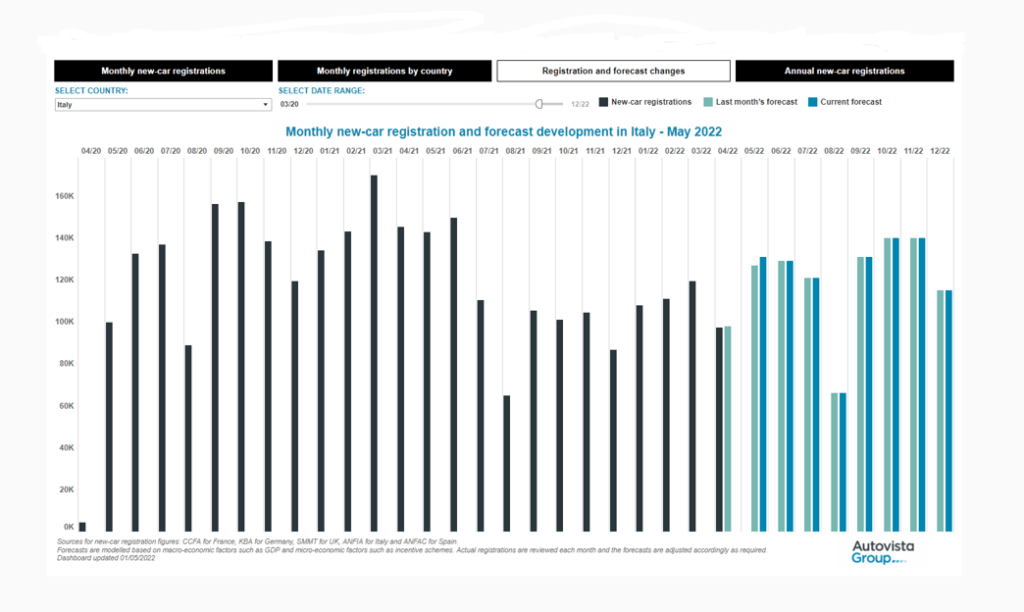

Monthly new-car registrations, Italy, April 2020 to December 2022

Growth ahead of 2025 market correction

Despite the easing of supply bottlenecks caused by the war in Ukraine, semiconductor shortages are still expected to persist into 2023 and probably beyond. Nevertheless, as a large volume of new-car registrations will be displaced from this year, double-digit growth rates are expected in all five key European markets next year.

Autovista24 forecasts that the volume of registrations across the five key Western European new-car markets will rise 21.6% to 10.1 million units in 2023, but this is still 10.6% lower than in pre-pandemic 2019. A return to comparative normality is expected in 2024, a year which is also expected to benefit from a pull-forward effect as automotive manufacturers and consumers seek to register cars ahead of the EU Commission’s target of a 55% reduction in CO2 emissions in 2025, compared to 2021 levels.

Autovista24 predicts 3.1% year-on-year growth in 2024 but foresees a modest correction in Europe’s leading new-car markets in 2025, except in Spain where an anticipated slower recovery means the market will be the furthest adrift from pre-pandemic levels in 2024.

The full interactive dashboard presents the latest and previous monthly forecasts for 2022, as well as the annual outlook for the big five European markets to 2025.