German carmakers face climate lawsuits and show chip-shortage impact on financials

10 November 2021

Autovista24 journalist Rebeka Shaid considers the issues hitting German OEMs as they report on their financial performances so far this year.

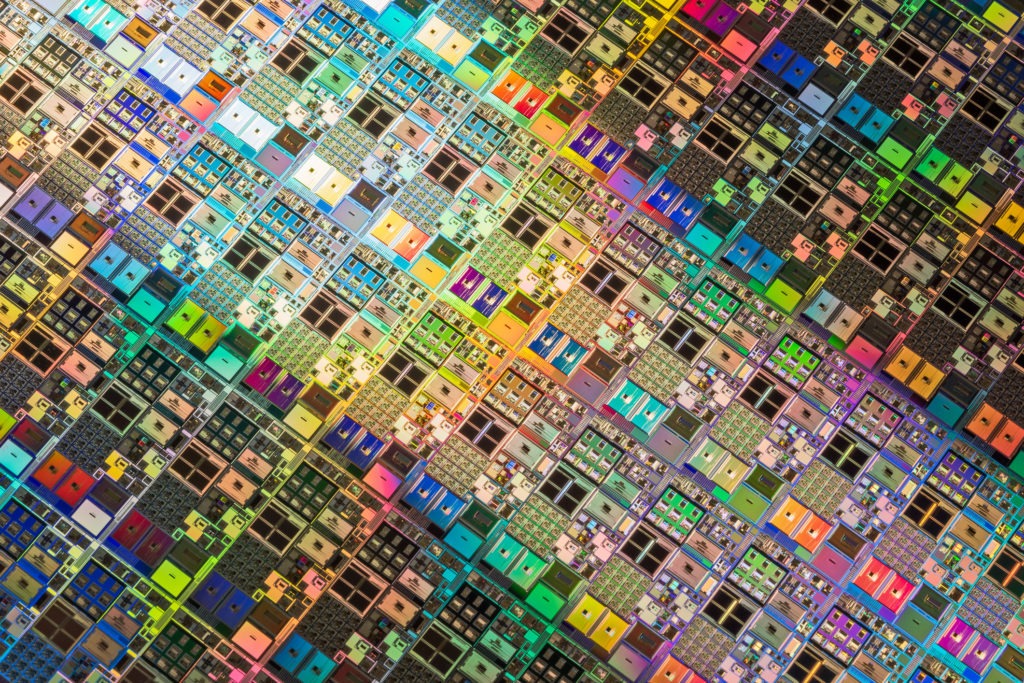

In recent days and weeks, German carmakers reporting third-quarter financial results have revealed the extent of the impact a global semiconductor shortage has had on their businesses. They are also grappling with lower output and supply-chain issues.

In light of the COP26 climate summit in Glasgow, car manufacturers have made numerous announcements, pledging to reduce emissions over the coming decades as they are looking at more sustainable ways to decarbonise the industry. However, environmentalists are not content with the progress being made.

Volkswagen Group (VW) is being sued by Greenpeace, with the environmental group accusing the company of ‘fuelling the climate crisis.’ The activists say VW rejected Greenpeace’s demands to cut its CO2 emissions faster and to phase out internal combustion vehicles (ICE) by 2030.

‘Car companies like Volkswagen need to take responsibility and act much faster to phase out the highly-polluting internal combustion engine, and decarbonise their activities with no further delay,’ said Martin Kaiser, executive director of Greenpeace Germany.

Courts not the place or means

In a statement to Autovista24, VW rejected those accusations.

‘It is the task of the democratically elected legislature to shape climate protection with its far-reaching effects. According to the principle of the separation of powers, it belongs to parliament to design the necessary measures. Disputes in civil courts through lawsuits against individual companies singled out for this purpose, on the other hand, are not the place and the means to do justice to this responsible task. We will defend this position,’ VW said.

The firm told Autovista24 it was the first automobile manufacturer to commit to the Paris Climate Agreement and that it aims to be carbon-neutral by 2050 at the latest. Measures the carmaker will take include a €35 billion investment in electromobility by 2025.

The Dieselgate scandal stained VW’s image, embroiling it in several high-profile lawsuits. The company told Autovista24 that it stands for climate protection and rapid decarbonisation of the transport sector, but that it cannot meet this challenge on its own.

Similar actions

A similar lawsuit was filed in September by a German NGO, Deutsche Umwelthilfe (DUH), against BMW and Mercedes-Benz. Both suits draw on two earlier cases: a landmark ruling by the German constitutional court in April 2021, declaring that future generations have a fundamental right to climate protection, with large companies equally bound by this requirement. Secondly, a Dutch ruling ordered oil giant Shell to cut carbon emissions by 45% by 2030 – the first time a company was legally bound to align its policies with the Paris climate accords.

Apart from potential legal woes, VW CEO Herbert Diess has also been involved in a clash with powerful labour representatives who are worried about huge job cuts. The company has ambitious plans and wants to become a world leader in electrically-chargeable vehicle (EV) sales. It is aiming to reform production as its focuses on electrification to keep up with rivals like Tesla, which has reported record profits.

Chip shortage cuts expectations

VW’s recent third-quarter results paint a sobering picture. The carmaker cut its outlook for deliveries as it struggles to meet demand because of the global chip crisis. It also lowered sales expectations and reported lower-than-expected operating profit. It said the risk of bottlenecks and disruption in the supply of semiconductors has intensified, especially since the second half of the year. Deliveries for this year are now expected to be in line with 2020, as market conditions remain challenging.

In the quarter, operating profit before special items was down 12% year-on-year, amounting to €2.8 billion – mainly because of supply issues. VW said rising competition, volatile commodity and foreign-exchange markets, as well as stringent emissions-related requirements continue to add pressure. Despite this, sales revenue in 2021 is anticipated to be ‘considerably higher’ than in 2020. The company reported that for the first nine months of the current year, sales were up by 20% to €187 billion.

The manufacturer is now working on its cost structure and on what it has dubbed its ‘new auto’ strategy, focusing on transforming the group into a software-driven mobility company. Electrification will also play a major role, with VW saying it had delivered 122,100 battery-electric vehicles (BEVs) in the third quarter – a record number and more than twice the amount from a year ago.

Strong EV sales

Hence it is not all bad news. VW’s German peer, Munich-based BMW, has also benefited from strong demand for EVs. During the first nine months of the year, the carmaker delivered 231,575 fully-electric and plug-in hybrid vehicles (PHEVs) – that is twice as many as a year ago. BMW saw sales of BEVs jump considerably, with the carmaker reporting a rise of 121%.

BMW’s third-quarter results beat analysts’ forecasts, with a 42% increase in quarterly net profits. These amounted to €2.58 billion as robust EV sales helped offset lower deliveries caused by the scarcity of chips. The carmaker expects dynamic EV sales to carry into 2022 although it is realistic about the rising raw-material prices, which impacted earnings this year.

Third-quarter group revenues were up by 4.5% to €27.5 billion, with the carmaker’s performance being driven by ‘favourable product mix factors’, positive pricing effects for new vehicles, as well as stable selling prices of pre-owned cars.

‘The BMW Group shows how profitability and transformation go hand in glove,’ said Oliver Zipse, BMW CEO. ‘We see technological change as a great opportunity to strengthen our business model on a sustainable basis. With our focus on climate-neutral mobility, we are consistently driving the company forward to make it future-proof.’

The manufacturer confirmed its full-year outlook and emphasised it was ‘relentlessly’ driving forward the process of becoming climate-neutral as decarbonisation remains a key goal for carmakers, especially in Europe. By 2023, BMW will have 25 electrified models on the roads – 13 of which will be BEVs. In the period up to 2025, BMW is set to grow sales of BEVs by an average of 50% annually.

Daimler powering through

Despite the chip crunch that saw a 30% drop in Mercedes-Benz cars and vans unit sales, Daimler powered through the third quarter, maintaining revenues and reporting a higher profit. It is particularly focusing on profitable luxury cars and aims to cut costs, anticipating to meet its 2021 profit targets.

‘We remain on track to meet our full-year targets thanks to a more robust business – resulting in an EBIT increase despite a challenging environment,’ said Harald Wilhelm, Daimler CFO. ‘At the same time, we made substantial progress with our strategic agenda: continuing the rollout of highly desirable electric vehicles.’

Group revenue in the quarter remained at roughly the same level as last year, coming to €40.1 billion. Meanwhile total unit sales dropped 25% because of the global supply constraints.

Daimler said economic conditions for demand for cars are likely to remain ‘favourable’ during the remainder of the year. It expects the strained supply chains for key components to have a considerable impact on worldwide vehicle production and continue through the fourth quarter.

Looking ahead, the firm anticipates an improved semiconductor-supply situation compared with the earlier three months. The chip shortage is likely to remain an ongoing issue in 2022, but Daimler said the situation should improve compared to this year.

The road ahead remains a bumpy one for the automotive industry, with not only German carmakers cutting or suspending production. At the same time demand from consumers remains high, particularly in the realms of electromobility as manufactures continue to push for electrification, hoping to cushion the blow of the chip deficit.