Massive effort required on UK electric-vehicle charging infrastructure to meet 2030 targets

24 March 2022

The SMMT is calling for all stakeholders to match its commitment to deliver zero-emission mobility, with extremely ambitious targets for electric vehicles (EVs) in the UK at risk.

Currently, just one in 80 vehicles on the country’s roads is powered by electricity. Government targets are for this ratio to drop to one in three by the end of this decade if net-zero ambitions are to be met. With the UK averaging around two million vehicle registrations a year, and last year’s record plug-in registrations just 305,281 units, a huge uptake in interest is required.

With the government planning to end the sale of new petrol and diesel cars in 2030, with only battery-electric vehicles (BEVs) and hydrogen fuel-cell vehicles (FCEVs) available from new-vehicle showrooms by 2035, more needs to be done to encourage the transition to zero emissions.

The SMMT is therefore calling on all parties integral to the drive to zero, including charge-point operators and government, to help ‘plug the gap’ between infrastructure rollout and uptake.

Both electric-vehicle charging infrastructure and affordability are crucial barriers to entry that need to be overcome by the industry and the government to get anywhere near this target, says the SMMT in its new report, Plugging the Gap.

Electric-vehicle charging infrastructure investment needed

The ratio of public standard chargers to electric vehicles has rapidly deteriorated as EV sales increased, with just one charging point for every 32 plug-in vehicles across the UK according to the SMMT. This is worse than the one for every 16 vehicles just 12 months ago, while there are also very significant regional variations. London has a high concentration of public electric-vehicle charging points, yet towns in the north of the country only have a handful, if any at all.

‘We have to make EV technology part and parcel of our everyday experience and we are expediting our efforts to create one of the best electric-vehicle networks in the world,’ Trudy Harrison MP, parliamentary undersecretary of state for transport, commented at the SMMT Electrified conference. ‘There are already 29,500 publicly available charge points, and 5,400 of these are rapid charging points. Last year the total number of public charge points increased by 37% and every month more than 600 new points are being added to the network.

‘All new homes, offices, and supermarkets will also have charging points installed, making around 145,000 a year. Meeting the needs of future drivers means pushing those numbers higher. We will harness the ingenuity of the motor industry, charge point and energy providers, and local government, to ensure we keep that momentum.’

The SMMT advocated a nationally co-ordinated, locally-delivered infrastructure plan, with binding targets for charge points that match those imposed on vehicle manufacturers. Overseen by a regulator, such a plan would put consumers at the heart of the transition, accelerating charge-point provision and addressing charging anxiety among drivers and businesses. It would also help the one in three households that do not have off-street parking and would therefore be reliant on public charging to make the switch.

‘If you have a home charger or have access to a charger at work, then 90% of the usage of your car is covered and you can have complete confidence in your ability to use your electric vehicle,’ Paul Philpott, president and chief executive at Kia UK, told the conference. ‘But on those long drives up motorways, people will worry about if they can charge en-route, if they can top up when they arrive, will someone be using the charging points and how long will they have to wait, and that whole anxiety is a new issue that we are facing now. The number of EVs on our roads today has increased by 600%, while rapid charging points have gone up 80%, and are not keeping pace.’

"When we build a chargepoint we know the cost of the chargepoint itself, but the variant factor is the cost of connection to grid, which can run into the millions"

— SMMT (@SMMT) March 23, 2022

Peter Feehan @Pinsent_Masons #SMMTElectrified pic.twitter.com/lp06TBUCKv

Peter Feehan, a partner at law firm Pinset Masons, went further, stating: ‘The cost of electric-vehicle charging infrastructure is not the issue, connecting it to the energy grid is. If we do not solve problems with grid infrastructure now, the UK will not meet its EV targets in 2030.’

Private motorists accounted for just a third of new plug-in registrations in 2021, with uptake far higher among businesses and fleets, which benefit from generous fiscal incentives. Conversely, purchase incentives have been rolled back dramatically over the past year, with the UK’s EV adoption now falling behind some European markets which offer more attractive incentive packages.

Battery manufacturing in the UK

A well-supported electric-vehicle market would help attract greater industrial investment, creating jobs and supporting economic growth, the SMMT believes. Gigafactory investment is essential if the UK is to achieve the 60GWh capacity it needs by 2030, a capability that would support the production of around one million electric vehicles a year.

This, in turn, would enable the industry to benefit from the UK’s ambitious trade agenda. It could maximise locally originating content to achieve tariff-free exports to key growth markets worldwide. This would help the UK to realise a zero-emission future with greater resilience and self-sufficiency in battery production and the wider electrified supply chain.

While the country’s gigafactory capacity is currently just 2GWh, there are major battery-production commitments that will come online in the coming years. This should take the UK’s estimated capacity to around 41GWh by 2027. However, the EU has a forecasted volume of up to 1.5TWh by 2040, with more than 25 gigafactories either under construction or in development.

‘The UK automotive industry has set out its intent to meet the challenge of net-zero, and has backed that ambition with cash, investing massively during Britain’s first electric decade,’ added Mike Hawes, chief executive of the SMMT. ‘As we enter the second, the stakes are higher, with some of the world’s toughest regulations coming that will seek to determine the pace of change in a market constantly buffeted by headwinds. But mandates on manufacturers alone will not drive the market.

‘Delivering net-zero needs a competitive industry and a competitive market. We need a holistic strategy with binding targets on charge point provision, attractive fiscal and purchase incentives, and a reliable, accessible and affordable user experience. We need a universal right to charge electric vehicles, for all drivers, wherever they live, wherever they travel, and whatever their needs.’

Decade of electric-vehicle spending

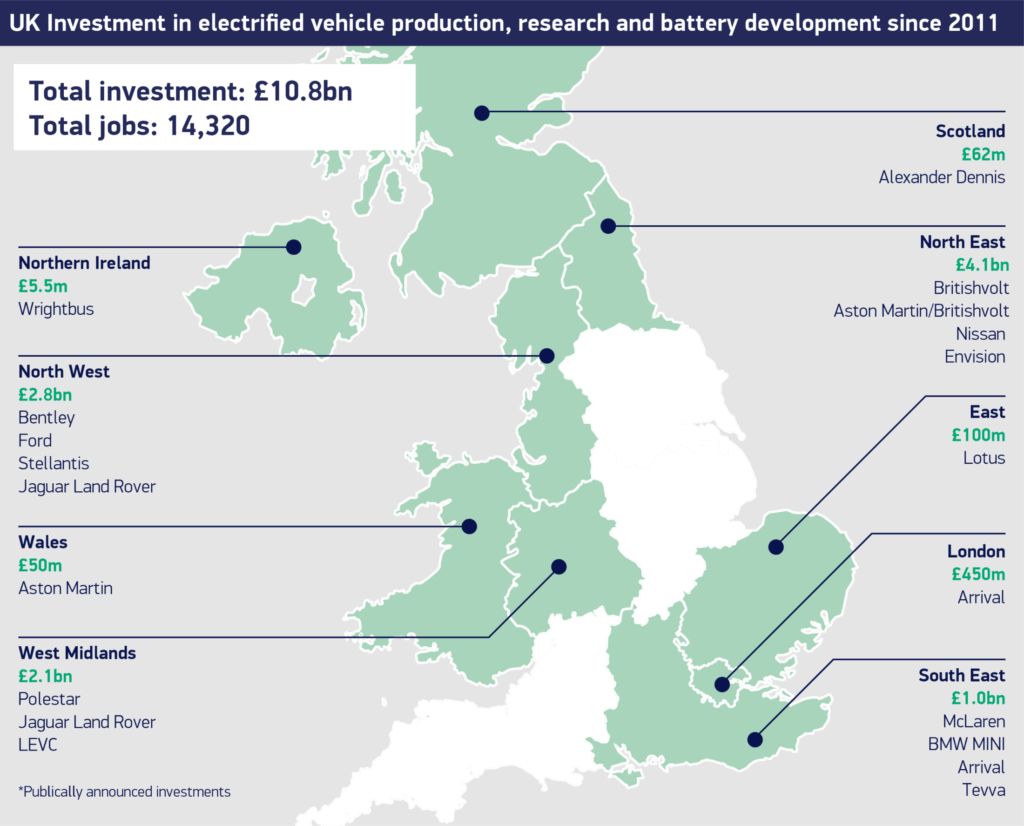

The country’s first ‘electric decade’ kicked off in 2011 with a £420 million investment in Nissan’s Sunderland plant to build the UK’s first mass-produced battery-electric vehicle, the Leaf. Since then, around £10.8 billion (€12.9 billion) has been dedicated to UK electric-vehicle production.

More than 10 vehicle manufacturers have made investments across the country to create jobs and to design, engineer and build the cleanest, greenest vehicles for domestic and export markets. Alongside cars, the UK also produces electric vans, buses and trucks, as established manufacturers and new entrants have invested in production.