Monthly Market Update: Residual values gain modestly in April but used-car activity slows

03 May 2022

Used-car sales activity was weaker in April 2022 than in the previous month across key west European markets, although the Easter holiday was a contributory factor. Compared to a year ago, the sales-volume index suffered double-digit declines last month, except in France. Nevertheless, with the war in Ukraine exacerbating supply constraints, residual values (RVs) enjoyed further growth, apart from in the UK.

Autovista Group’s used-car coverage in the monthly market dashboard features Austria, France, Germany, Italy, Spain, Switzerland, and the UK. It also includes a breakdown of key performance indicators by fuel type, average new-car list prices, as well as sales-volume and active market-volume indices.

War in Ukraine suppresses supply and demand

Since Russia invaded Ukraine on 24 February, oil prices and, in turn, fuel prices at the pump have risen sharply across Europe. This is adding higher vehicle-running costs to the mounting inflationary pressure on household budgets. There is also the potential for higher list prices for new cars as costs of raw-materials, such as palladium (used in catalytic converters) and nickel (used in electric-vehicle batteries), have spiked. The sanctions imposed on Russia will also have economic implications and the financial squeeze on household budgets may lead consumers to delay purchase decisions, for both new and used cars.

The war in Ukraine has also added another layer of disruption to fragile automotive supply chains. For example, Ukraine is a vital source of neon gas, which is used in the lithography stage of chip manufacturing and the reduced supply is adding to the pre-existing challenge of sourcing semiconductors for automotive production.

Although no major additional production stoppages have been announced over the last month – and production of the Skoda Enyaq iV has resumed for example – the outlook for new-car registrations in Europe’s key markets has been tightened. This will also reduce the stock levels of used cars and RVs could therefore benefit, but this also assumes used-car demand remains comparatively buoyant.

The Autovista Group residual-value outlook for 2022 has been upgraded in Austria, Italy, and Switzerland this month. Conversely, the UK RV outlook has been downgraded further as market activity is notably subdued. The outlooks for France and Spain are maintained, so too is Germany after an upward revision last month.

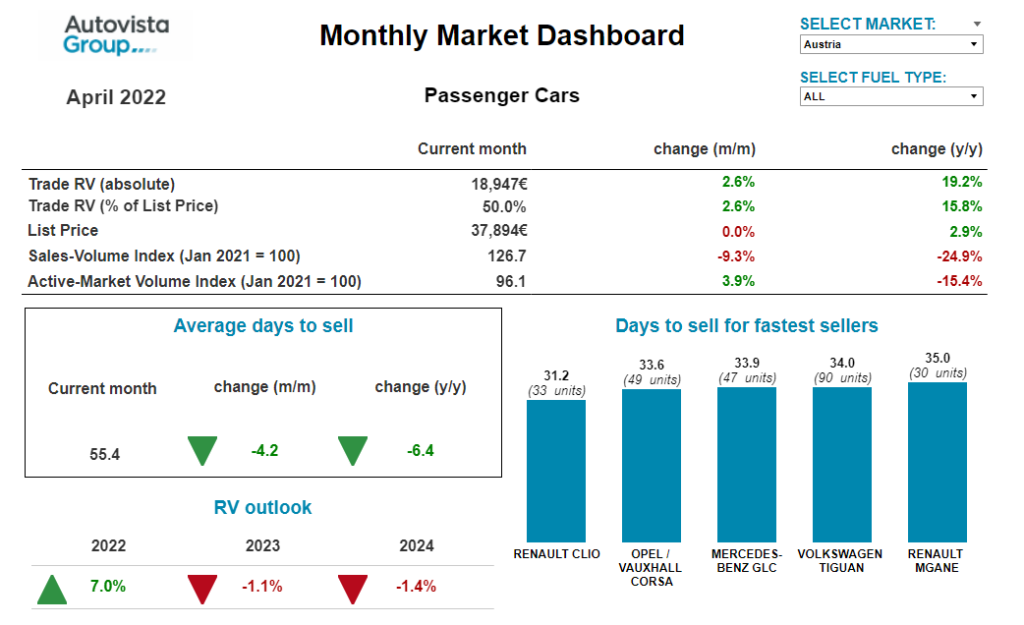

Supply key to RV growth in Austria

The Austrian used-car market continues to be underpinned by stable demand and low supply. On average across all passenger cars aged two-to-four years, the supply volume in April was 15.4% lower than in April 2021, notes Robert Madas, Eurotax (part of Autovista Group) regional head of valuations, Austria, Switzerland, and Poland. Diesel cars are still missing from the market, with a drop of 22.5% compared to April 2021. The supply of battery-electric vehicles (BEVs) showed an even stronger downward trend, with a fall of 36.9% year on year, and as demand for used BEVs improves, supply is falling especially short.

In the ongoing context of used-car demand outstripping supply, average days to sell decreased compared to March to an average of 55.4 days. Hybrid-electric vehicles (HEVs) are selling the fastest, averaging 46.1 days, followed by diesel cars with 54.5 days. Plug-in hybrids (PHEVs) are selling the slowest, averaging 64.9 days. This market environment has also led to a further increase in RVs of 36-month-old cars. Values have risen by 15.8% year on year, with cars retaining 50% of their list price on average. Petrol cars are currently leading with a trade value of 51.1% of list price, followed by HEVs (50.8%) and diesel cars (49.7%). 36-month-old BEVs retain the lowest value, with 43.2%.

Madas believes the market parameters will not change in the medium term, because new-car registrations are still markedly lower than before the crisis (2021 was down 27% compared to 2019). However, the disrupted supply of new cars, exacerbated by the war in Ukraine, will be the key factor in the future development of RVs. Supply chains are already affected and together with the ongoing semiconductor shortages, this will lead to even longer delivery times for most new vehicles. Due to this undersupply, Madas forecasts that RVs of three-year-old passenger cars will continue to rise this year. Only when the new-car market picks up significantly, and thus volumes on the used-car market also increase, are values likely to come under pressure. This will probably not be the case before 2023, Madas concludes.

Used-car prices ‘too high for buyers’ in France

In France, there was a stabilisation of RVs in value-retention terms (%RV) for almost all fuel types in April. ‘This tends to prove that used-car prices are now clearly becoming too high for used-car buyers,’ commented Yoann Taitz, Autovista Group regional head of valuations and insights, France & Benelux. However, demand remains strong as high new-car list prices push customers to the used-car market. As used-car stocks are steadily drying up, the number of stock days is falling for all powertrains except PHEVs.

‘Although RVs of HEVs and PHEVs remain at a high level in value terms, the %RV is starting to fall for some models, showing that they have reached their peak. Despite the low supply of PHEVs, RVs are decreasing as the additional cost for the technology is too high,’ Taitz explained.

In terms of BEVs, residual values continue to grow, as they have done since the start of the year and especially since the beginning of the war in Ukraine. Nevertheless, this is more of a rebalancing as in the last quarter, while all other powertrains were increasing, BEVs were declining. Nevertheless, the %RV of BEVs remains far below other fuel types – around 20 percentage points below petrol, diesel and HEVs.

The positive development of BEV RVs is partly explained by the strong rise in fuel prices in recent weeks, which have gained €0.70 to €0.90 at the pump in some regions because of the Ukrainian conflict. Furthermore, the incentive for new BEVs will decrease by €1,000 in July 2022, pushing up prices. As this bonus is only effective for cars delivered to customers before the end of September and delivery times are very long, customers are ordering new cars now to benefit from the €6,000 subsidy.

‘From my point of view, this surge of interest in BEVs is more a conjunctural movement than a structural one. When fuel prices will come back to a more acceptable level, interest should decline. As fuel prices have fallen back below €2 for several days, the interest in BEVs is less strong than before. Some weeks ago, we observed in dealerships an irrational and strong interest in BEVs from customers, even though their car usage is not really in line with BEV expectations,’ said Taitz.

Nevertheless, this situation is allowing car dealers to reduce the high stock levels of BEVs, including older models. Hence, stock days have significantly reduced, by 32 days compared to a year ago.

‘In summary, it is still too early to confirm that the French BEV market is taking off. However, for sure, there is stronger interest in BEVs, which is leading to higher used-car prices. The summer holidays, including the usual road trips in July and August, will be a real test for new BEV customers as they experience the lack of charging infrastructure in France,’ Taitz concluded.

As it stands, Autovista Group forecasts that RVs of BEVs will decline by 3% in 2022 and 2% in 2023.

Electric vehicles entering ‘a difficult phase’ in Germany

Plug-in hybrids have ended their rapid volume growth in new-car registrations in Germany, compared to their already inflated level last year. ‘Ultimately, this volume development was one of the reasons why PHEVs and BEVs benefited far less from the price increases in the overall used-car market than internal-combustion engines (ICE), especially diesel vehicles.’ explains Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group).

A significant share of new BEVs has been disappearing abroad as young used cars for quite some time due to the significantly higher price potential in some locations beyond the German border. Of almost 200,000 new BEV registrations in 2020, just under 160,000 vehicles were still registered in Germany at the turn of the year 2021/22, and PHEVs are behaving similarly. ‘The supply volume is therefore reduced by exports and the remaining quantities need to satisfy overall used-car demand that cannot be met with internal-combustion vehicles only. In addition, used EV demand is gradually getting underway, which brings with it positive RV effects,’ said Geilenbruegge.

Overall, however, residual values in all sectors have reached a level where potential customers seem to be literally running out of money. ‘There is still a general slight upward trend on average, but it is no longer impacting all prices and some models and registration years are being left behind,’ Geilenbruegge noted. ‘No significant price drop is to be expected for internal-combustion vehicles due to a lack of supply, but electric vehicles are now entering a difficult phase and should be brought to market attentively and with a realistic pricing strategy.’ Geilenbruegge concluded.

International tensions support RV stability in Italy

The trend of broadly stable residual values continued in April in Italy, with a moderate rise of just 0.4% month on month in %RV terms. However, prices remain significantly higher than a year ago – the value of a 36-month-old vehicle with 60,000 km currently averages €16,729, 15.4% higher than observed in April 2021. The ‘used-car fever’ is also clear when considering stock days, which have decreased by about four days compared to last month, with the Volvo XC60 and Renault Kadjar even selling in fewer than 20 days.

‘Current international tensions will almost certainly contribute to slowing down the return to pre-pandemic levels, whereby residual values in Italy are expected to grow by 4.4% at the end of the year compared to December 2021,’ explains Marco Pasquetti, forecast and data specialist, Autovista Group Italy.

Residual values are higher than a year ago across all fuel types, with diesel seeing the most significant growth (up 29.2%) and PHEVs the least, rising just 1.8%. Prices of used BEVs are improving, rising 2.2% compared to last month, and sales have almost doubled compared to January 2021. Pasquetti also notes that despite the sharp rise in fuel costs, LPG-powered cars sold very quickly last month: after only 40 days on average, 10.5 days fewer than a year ago.

‘Convulsive’ used-car market in Spain

April marked the return of an increasingly convulsive used-car market in Spain, explains Ana Azofra, Autovista Group head of valuations and insights, Spain. On the one hand, sales are down compared to the same period in 2021 and the lack of product is worsening the outlook. On the other hand, the structure and profile are deteriorating: the shortage of supply means that the share of young cars up to four years old continues to fall sharply, while the share of older vehicles is increasing, contributing to the ageing of the fleet. Specifically, 40% of used-car transactions are for vehicles over 15 years old.

Imports continue to grow month by month but are not sufficient to meet demand. The lack of used-car supply, stemming from a new-car market that continues to be weighed down by the semiconductor crisis, continues to push up prices. RVs have already risen by more than 20% year on year for some cars, particularly in the small petrol-powered segments.

Although their positive evolution was more delayed than traditional combustion engines, hybrids continue to show RV growth. Prices of used BEVs are timidly improving, with sales figures in the used-car market growing, partly due to the MOVES incentive schemes.

The conflict in Ukraine and the inflation caused by the current situation will continue to drive demand to the used-car market, which will still see price increases in 2022 and 2023.

‘An expected decrease in electricity prices will help BEV development and thus potentially improve their RVs, provided this is accompanied by the necessary infrastructure improvement and reasonable price positioning in the new-car market,’ Azofra added.

Modest price uplift in Switzerland

For the past two years, the Swiss used-car market has been characterised by high demand, low supply and rising used car-prices. On average across all two to four-year-old passenger cars, the supply volume in April was 2.9% below the level of a year ago. Already in 2021, the supply was significantly lower than at the beginning of 2020, notes Hans-Peter Annen, head of valuations and insights, Eurotax Switzerland (part of Autovista Group).

Diesel cars in particular are missing on the market, with supply 23.4% down compared to April 2021, whereas there are currently 10.4% more two to four-year-old petrol cars offered than a year ago. For HEVs, market activity is high in relation to the level of supply, which is 6% lower than a year ago. The offered volume of PHEVs is also 6% down year on year but the volume of BEVs has decreased by 15%. The demand for PHEVs and especially BEVs is exceeding supply significantly.

The average days to sell decreased slightly in April: a passenger car aged two to four years is currently in stock for 59 days. HEVs are selling quickest, after an average of 56 days, followed by petrol cars with 57 days, diesel cars with 60 days, BEVs with 70 days, and PHEVs with 77 days. However, BEVs are selling 10 days quicker than a year ago.

This market environment led to a further increase in the average %RV of 36-month-old passenger cars, to 48.2% (+17.9% compared to April 2021). Petrol cars posted strong year-on-year %RV gains of 17.8%, to 49.3%, as too did diesel cars (up 17.1% to 46.3%).

Further disruption to the supply of new cars because of the war in Ukraine will be a key factor in the future development of RVs, as well as the recent list-price increases. Supply chains for different parts and raw materials are heavily affected, leading to long delivery times for most new vehicles. As new-car registrations in 2022 are markedly lower than before the COVID-19 pandemic (2021 was down 23.4% compared to 2019), the market parameters will not change in the medium term. Annen predicts that RVs for three-year-old used cars will continue to rise this year, before stabilising and declining over the years 2023 and 2024.

Poorer retail demand in the UK

Comparisons with April 2021 show that the average residual value of a three-year-old car is 34.8% higher this year, suggesting that the UK used car-market continues to perform well. However, all this growth occurred between the second and fourth quarters of last year. ‘The used-car market has been very different in 2022, with much poorer retail demand than dealers became accustomed to in 2021,’ highlights Jayson Whittington, Glass’s (part of Autovista Group) chief editor, cars and leisure vehicles.

RVs fell by 2% month on month in April and considering current lacklustre wholesale used-car activity, prices are expected to depreciate in May too. ‘This is by no means unusual as cars are considered to be depreciating assets, but it is a significant shift away from the trend seen for the majority of last year,’ Whittington notes.

It took dealers on average four days fewer to retail a car in April than in March, but at 49.9 days, this was 1.7 days longer than a year ago. ‘Bearing in mind that in April last year the UK had just emerged from three months of lockdown, with dealer stock ageing more than usual as consumers had less access to physically view cars, it is somewhat surprising that average days to sell are as high as they are,’ Whittington commented. ‘This underlines how poor current used-car retail demand is.’

Nevertheless, the RV outlook for the UK remains reasonably positive as prices have a long way to fall just to get back to where they were prior to the spike last year. Glass’s current view is that by year end, RVs will fall around 12% from where they were in December 2021.

The April 2022 monthly market dashboard provides the latest pricing, volume and stock-days data.