UK new-car market recouples in October after September derailment

08 November 2022

The UK’s new-car market recorded its third consecutive month of year-on-year growth in October. Moreover, activity rebounded following weakness in September, which was partly derailed by the period of national mourning surrounding the funeral of Queen Elizabeth II.

‘Fulfilment of strong order books helped deliver the bounce-back, although the increase follows a particularly disappointing October 2021 when deliveries fell by 24.6%,’ the Society of Motor Manufacturers and Traders (SMMT) commented.

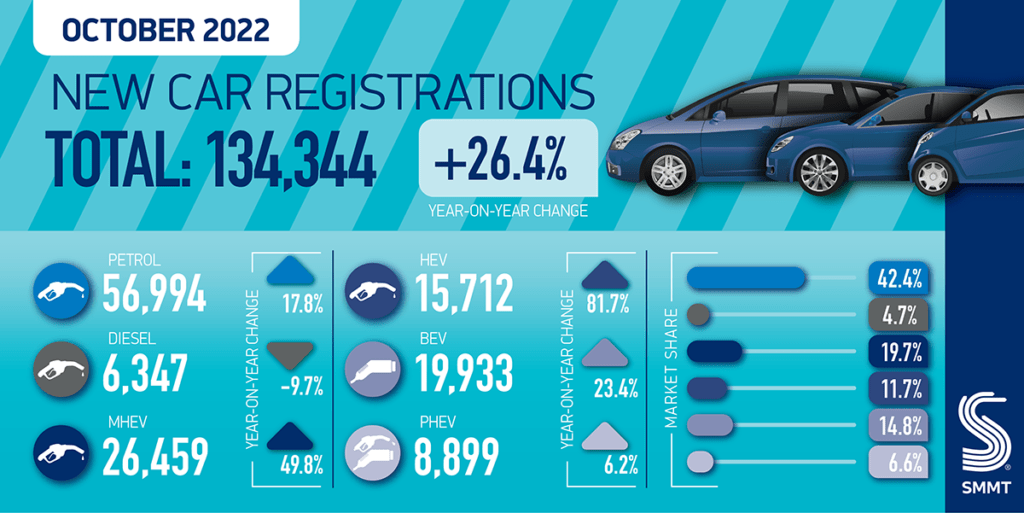

The SMMT reports that new-car registrations increased by more than a quarter (26.4%) last month, to 134,344 units. This follows on from a 4.6% gain in September, although factoring in the extra working day last year, Autovista24 estimates that the volume of registrations grew 9.6%. Furthermore, the seasonally-adjusted annualised rate (SAAR) recovered to nudge two million units in October, following the slump to 1.4 million units in September, even when adjusted for the lost working day.

However, with only 1.34 million new cars registered, the market has contracted by 5.6% in the year-to-date and is about a third smaller than in pre-COVID 2019. ‘A strong October is hugely welcome, albeit in comparison with a weak 2021, but it is still not enough to offset the damage done by the pandemic and subsequent supply shortages,’ said SMMT chief executive Mike Hawes.

As supply shortages persist and the cost-of-living crisis shows no sign of abating, the outlook for the country’s automotive sector remains particularly uncertain.

Forecasts for 2022, 2023, and 2024

Speaking at the SMMT market outlook webinar on 7 November, the association’s economics manager, Matthew Croucher, commented that the UK has ‘had three prime ministers in very quick succession and a couple of chancellors.’ The recent political turmoil in the country does not boost consumer confidence, especially as the consumer prices index (CPI) rose back above 10% in the 12 months to September 2022 and the Bank of England increased interest rates by 0.75% to 3% on 3 November. ‘They normally cut rates when going into a recession,’ Croucher commented.

Nevertheless, the sharp upturn in the UK last month contrasts with the deceptive growth in France, Italy, and Spain, as well as in Germany. Moreover, the UK was the only one of the big five European new-car markets to exceed Autovista24’s prediction for October. Supply is expected to continue to improve but Autovista24 predicts that the SAAR will drop back below two million units in November and December, resulting in 1.58 million new-car registrations in 2022, down 3.9% on 2021.

The SMMT is slightly less optimistic and has downgraded its 2022 forecast to 1.57 million units. The association commented that ‘this puts 2022 on course to be the market’s toughest year since 1982.’ In the outlook webinar, Croucher added that this latest forecast is ‘330,000 units down on what we expected in January.’

Croucher highlighted concerns that the average energy price cap ‘will go from £2,500 to £4,500 from April 2023’ and that ‘low unemployment has been supporting the new-car market but could rise quite dramatically.’ The mounting financial pressure on businesses and consumers alike will inevitably suppress underlying demand and, responding to Autovista24, Croucher conceded that ‘we do not track orders at the SMMT, but we have heard that footfall is a bit weaker.’

However, three quarters of respondents to a recent SMMT survey believe supply-chain issues will not be resolved until the second half of 2023. The remainder said problems will likely continue into 2024 or beyond. The upside is that ‘most people are on three-year PCP deals that generally support replacement and the backlog of orders will help us to grow as expected,’ Croucher commented.

Although countless new-car orders will not be fulfilled this year, the economic headwinds mean Autovista24 has cut its new-car registrations outlook for 2023 and 2024 to below 1.8 million units and just over 1.9 million units respectively. These align with the SMMT’s latest forecasts of 1.81 million and 1.95 million units.

BEV market share falls

Despite the UK government’s termination of the plug-in car grant (PiCG) on 14 June, registrations of new battery-electric vehicles (BEVs) gained 23.4% year on year in October, to 19,933 units, and plug-in hybrids (PHEVs) increased by 6.2% to 8,899. Croucher commented in the webinar that ‘the PiCG only accounted for 20% [of EV registrations] and so the impact has been modest and long lead times mean the effect will not be seen immediately.’

The SMMT also noted that ‘BEV uptake grew by less than the overall market for the first time since the pandemic, meaning October is the first month to see the BEV market share fall year on year since May 2021, primarily attributable to supply challenges.’ Croucher did point out that registrations of Chinese brands have increased by about 60%, with their share of the UK’s BEV market reaching 28%.

In sharp contrast to BEVs and PHEVs, registrations of new hybrid-electric vehicles (HEVs) jumped 81.7% year on year ‘to account for more than one in 10 new cars, as supply was prioritised for a raft of popular new models,’ according to the SMMT. ‘Overall, electrified vehicles accounted for one in three registrations, while more than a fifth (21.5%) came with a plug.’ Croucher added that

‘company-car drivers were the cornerstone of diesels, but they have moved into electrified vehicles.’

Charging targets in jeopardy

The SMMT forecasts that BEVs will account for 22% of UK new-car registrations by 2024, and 80% by 2030. However, the automotive body is concerned that the development of charging infrastructure is not keeping pace.

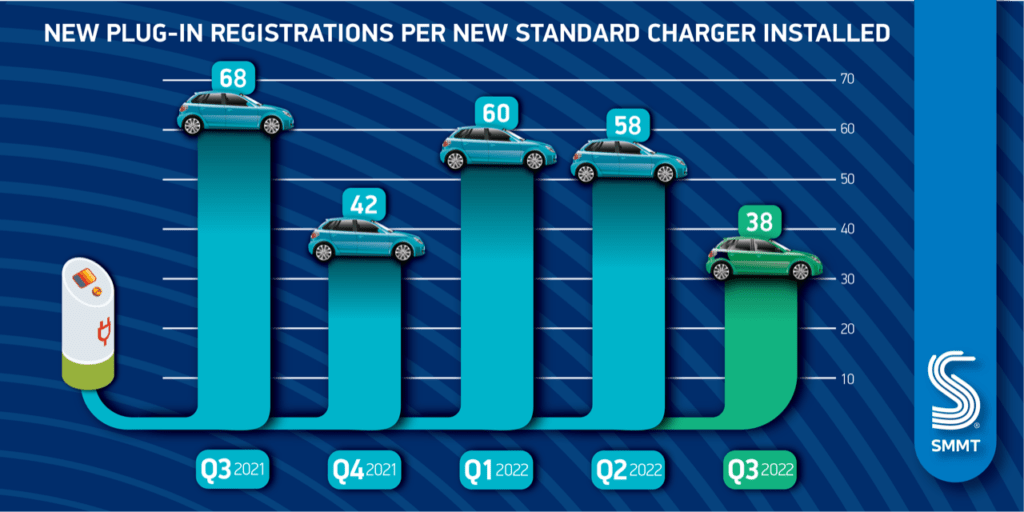

‘At the start of October 2022, the UK had 34,637 public standard, rapid and ultra-rapid electric-vehicle charging devices, with 1,239 new rapid chargers and 5,023 new standard chargers installed during the first nine months of the year,’ the SMMT said. ‘With 249,575 new plug-in registrations during the same period, just one new standard public charger has been installed for every 50 new plug-in EV registrations. At this rate, it is unlikely that government’s ambition for 300,000 public chargers by 2030 will be met.’

‘With stretched infrastructure and the cost-of-living crisis both having the potential to undermine future uptake, government’s Autumn Statement, set for 17 November, provides an opportunity to stimulate demand and deliver both economic growth and net-zero progress,’ the body added.

‘Now is not the time to raise motorists’ costs, which would likely stoke inflation and damage broader government revenues from new-car sales. A long-term fiscal commitment to zero-emission motoring would do much to stimulate investment and demand,’ the SMMT concluded.