Polish automotive market grapples with uncertainty

21 January 2022

There are many indications that 2022 will be another year of uncertainty, according to Marcin Kardas, head of editorial at Eurotax in Poland (part of Autovista Group). He looks at how the Polish market could develop this year and beyond.

2021 was certainly extraordinary for the automotive market in Poland. Two years ago, no one would have imagined that the problem would be the production of cars or the timing of their delivery, and prices would increase by several dozen percent. The reasons for this are well-known and directly related to the pandemic, disruptions in supply chains, and the drastic increase in raw material prices.

Worse news is the lack of real prospects for improvement. Currently, there is no clear timeframe for recovery. There are many indications that 2022 will be another year of uncertainty, which will only deepen the crisis and magnify its effects. In such a situation, it is worth considering how this will affect the secondary car market and residual values.

The long-term effects of the deficit of new cars because of poor sales in the last two years means fewer used cars will become available, when they should be returning from fleet contracts. The cost of vehicles will remain expensive. This dynamic sits against the backdrop of European ambitions to develop the sale of electrically-chargeable vehicles (EVs). Due to the limited and, as yet, unproven demand for used EVs, the situation could be very volatile. It will depend not only on the awareness of buyers, but also on decisions on electromobility, such as the introduction of green zones in cities and the development of infrastructure. These plans can determine the demand for used EVs and reinvent their values. Metal prices and the economic environment also remain a big unknown.

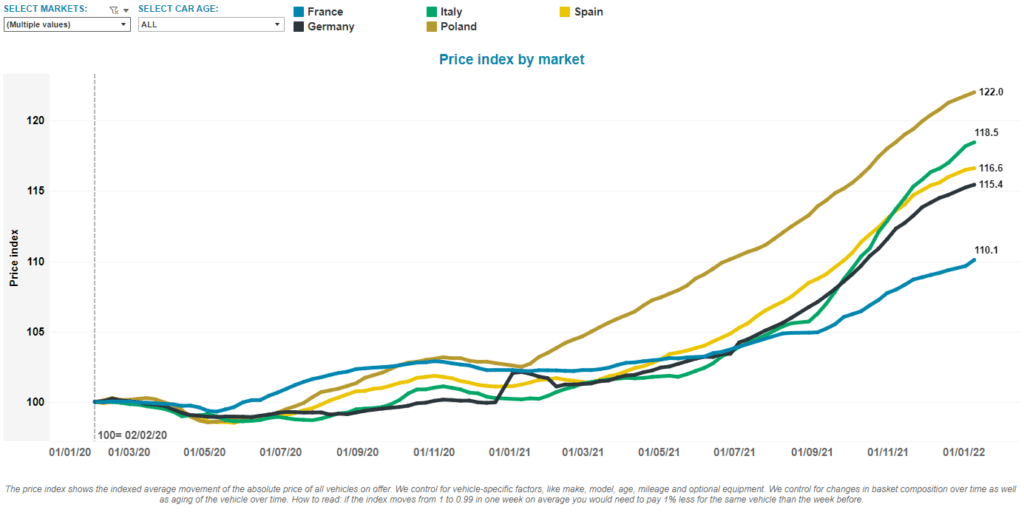

2021 was a period of tremendous growth in the demand for used cars in Poland. The lack of availability of new cars, as well as the desire to avoid public transport, resulted in a rapid shrinkage of available vehicle-purchase options in Poland and Europe. The shortage of supply had an obvious impact on used-car prices, which subsequently soared. Poland, as a country with a significant share of the secondary market, felt the effects very quickly.

The scale of rising prices was and still is the highest among all European continental markets. Up until the middle of the year, they were twice as high as in the rest of Europe, but the situation is starting to change.

Rapidly rising prices in Western Europe will lead to a lack of used cars there as well. This, in turn, bodes badly in terms of imports to Poland. As a result, 2022 is likely to experience a deepening shortage and further price increases, especially for older cars.

In addition, the lack of availability of new cars curtails their replacement in fleets, which also means that the market is no longer supplied with newer used cars. Thus, further price increases across the entire age range are likely.

Manufacturers are increasingly offering EVs in place of affordable internal-combustion engine (ICE) vehicles. The costs of this process are huge and are passed on to new ICE-vehicle prices. This means that ICE-vehicle prices are slowly catching up with those of EVs, although until recently the reverse was expected with a decline in EV prices. The latest information on the rise in the prices of metals and rare-earth elements suggests that the cost of electricity may soon begin to rise.

New cars will surely become much less available, not only due to production problems, but also because of the cost of acquiring them. In such a situation, car subscriptions could develop.

Harder impact of LCVs

Passenger cars are not the only vehicles affected. The commercial-vehicle market has had even deeper consequences. Vans traditionally have a longer service life, so stocks of used vehicles have always been limited. With the rapid development of online trade during the pandemic, demand has grown. The effect was the same as for passenger cars with a sharp increase in prices, but the scale was almost twice as high. A similar trend is observed in most European countries. This is a serious problem that will be very difficult to tackle this year and beyond.

Problems related to delivery from Asia caused a demand for goods produced in Poland, which translated into a huge demand for heavy international transport. The carriers started shopping en masse, and the waiting time for ordered new tractor units is currently 12 months.

The used market was also strongly affected. Used cars quickly disappeared despite the huge stocks accumulated in recent years and their values reached very high levels. Much now depends on the economic situation. Should there be a slowdown, the demand for tractors will certainly decrease, which will ease the situation somewhat. Another problem is the rising cost of transport due to the increase in fuel prices, especially gas. LNG tractors have been a hit on the market recently, and the price of fuel compensated for much higher purchase costs. The economics of their operation is being questioned and, in 2022, it may turn out that many fleets will want to get rid of them.

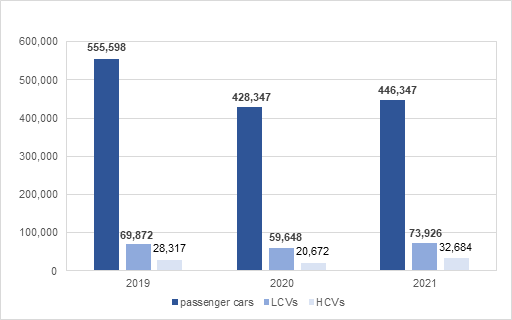

Sales of new cars last year were more dependent on production capabilities than on demand. In addition to touring buses, all types of vehicles enjoyed great popularity. Passenger cars failed to return to pre-pandemic levels, but commercial vehicles sold well and achieved record results. This is borne out by the rapid economic development and the related increase in transport demand.

New-car registrations 2019-21

Production issues are unlikely to go away this year, exacerbating the shortage of used cars. In this case, prices should continue to rise, and residual values will follow.