Does online-only used-car remarketing stand a chance?

18 October 2021

Online car retailing is a transparent way of publishing the haggle-free price of both new and used vehicles. However, it is difficult for consumers to assess the quality and, moreover, price of used cars without a physical viewing and test drive. Autovista24 senior data journalist Neil King considers the advantages and challenges in online-only used-car remarketing.

Given the large consumer-to-consumer element of the used-car market, removing reliance on physical dealers, used-car sales fared far better through COVID-19 in 2020 than new-car registrations. The first wave of the pandemic stopped sales activities at dealerships that were not digital at all. However, the less pronounced downturns in the second wave of lockdowns in the UK, for example, exemplify how the establishment, and increased consumer acceptance, of online purchasing and ‘click-and-collect’ operations, significantly improved the fortunes of both the new and used-car markets.

Balancing costs and opportunities

Online-only used-car remarketing requires additional effort, and costs. This includes evaluating every car meticulously and deciding on which vehicle defects to repair (or not), which incur costs and erode profit margins.

For this reason, the companies set limits on the age and mileage of the used vehicles that they source. In the case of the UK’s Cinch, the cars offered online are all under seven years of age and have covered less than 70,000 miles (113,000km).

‘In terms of our vehicles, we are currently only buying cars from our customers that have been manufactured after 2005 with less than 200,000km and that are in good condition with a clear ownership history,’ explained Stan Galik, CEO of Driverama, Europe's online, borderless, used-car retailer, to Autovista24.

With online-only used-car remarketing, it is then essential to ensure that every possible aspect of a car is transparent for customers to make an informed decision, by publishing high-quality pictures and videos. Furthermore, providing a home-delivery service presents a logistical challenge and adds further costs. Ultimately, there is also a risk that used cars may be returned.

However, online used-car sales present an opportunity to better engage with customers - and with more customers - irrespectively of whether the actual transaction is done online or offline. In an offline-only world, dealers would struggle, as happened during the pandemic.

‘There is also an opportunity to price cars more intelligently and used cars remain a source of substantial profits if you do things right,’ commented Dr Christof Engelskirchen, chief economist at Autovista Group.

Additional online-only challenges for used-car remarketing

For online-only used-car retailers without a physical dealer presence, there are additional challenges, including;

- Sourcing good-quality used cars

- Deciding in which country to sell them

- Warranty duration and costs

- Offering test drives.

‘Selling used cars online requires a sophisticated approach to describing every little piece of the car in much detail, with pictures. Without this, there are high risks of unsatisfied customers and high numbers of returns - the biggest challenge for all online retailers,’ commented Engelskirchen.

Online retailers, such as Auto1 in Germany as well as Cinch and Cazoo in the UK, will always seek to minimise returns as the logistical costs for car deliveries are prohibitively high and eat into the margins.

Restricted access

Another challenge for online-only used-car remarketing – beyond detailed vehicle descriptions and the lack of price transparency – is that used-car retailers usually offer cars at the lower end of the market rather than at the higher end. Valuable one-to-three-year-old used cars, which could absorb some of the logistical costs, are typically out of reach as they are sold on by leasing companies and captive finance companies. Access to premium used vehicles is almost impossible for digital remarketers too.

A major side effect of operating at the lower end of the market is the reduced profit margins. Even if online-only companies can make the low end of the market work, they are dealing with very price-sensitive customers. They also always have to balance between repairing and fully refurbishing used cars up-front - which adds costs, time, and cuts into margins - and selling cars with cosmetic defects such as scratches and dents.

‘You need to sell three to four times as many cars compared to a three-year-old Audi A6 for the same margin, and there are more damages to either repair or make transparent,’ Engelskirchen highlighted.

OEMs and leasing companies have two further advantages in the digital used-car marketplace.

First, they can establish online sales capabilities around ‘seamlessly integrating online and offline buying experiences,’ commented Engelskirchen. The idea is that the customer can move from online to offline and back again without any issues, and especially without any implications for the price they pay for a used car. ‘Online-only companies such as Auto1 could to that too, but it is more difficult and costly for them,’ Engelskirchen added.

Secondly, OEMs and leasing companies seek to offer car subscriptions, leasing contracts, and/or servicing contracts for new and used cars to avoid them ever hitting the market. This also keeps them close to their customers. Of course, they cannot monopolise all cars – at some point down the age-line, this practice becomes too expensive and customers too price-sensitive - but it certainly prevents many cars from going to online-only businesses.

‘For battery-electric vehicles (BEVs) in particular, the used-car market is a relatively unknown quantity and buyers would welcome the chance to gain access to the cars without holding the asset risk,’ commented Engelskirchen.

Scale is crucial

Given the lower margins from not having access to valuable young and/or premium used cars, scale is crucial for online-only used-car retailers.

‘The digital marketplace for used cars in Europe is rapidly growing and developing as consumers are increasingly buying online, with around 20-30% of people now considering buying a car online. The used-car market is 2.1 times larger than the new-car market, and the value of transactions is continuously increasing as the average car value grows,’ Galik highlighted.

At the time of writing, Cazoo and Cinch offered 2,752 and 5,349 used cars respectively in the UK. Even combined, however, this only equates to 2% of the 400,000 used cars listed by the country’s leading online car-sales platform, AutoTrader.

Geographic reach also restricts access to used cars and where to sell them, especially for operators in the right-hand-drive UK market. Cross-border distribution and retailing of used cars is established across Europe.

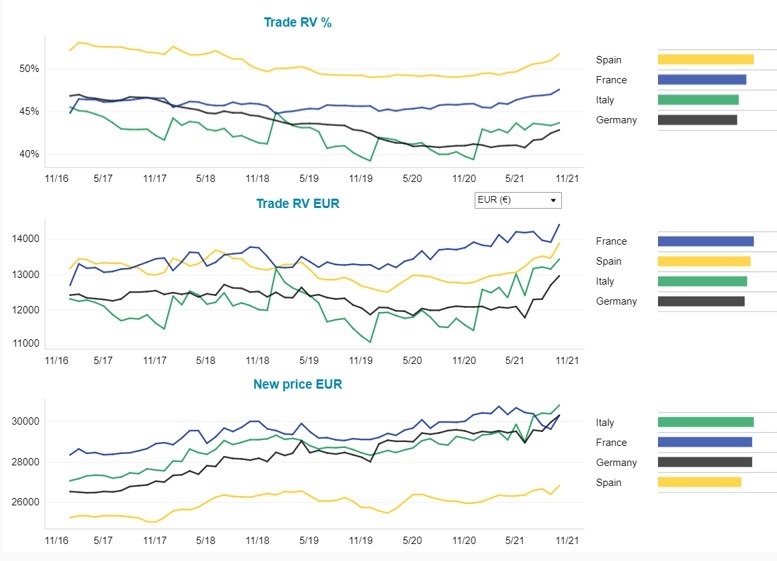

A look at the new-car prices and residual values (RVs) of used C-segment cars in Europe’s major markets points to the advantages of an international presence. The average price of new cars in this segment is lower in Spain than in France, Germany, and Italy. However, RVs after 36 months and 60,000km are only lower than in France and, accordingly, value retention (%RV) is highest in Spain.

New-car prices and residual values (36m/60,000km), C-segment, January 2017 to October 2021

The importance of geographic spread and a physical presence has not escaped Driverama.

‘Germany is by far the strongest and most developed market for used cars, valued at around €90bn, which is why we have launched our operations there and have already seen a very positive reaction from our customers, across all age groups. We are particularly proud that after three months of launching our first retail buying branch, we are the most trusted used-car platform in Germany according to Trustpilot,’ said Galik.

The company plans to enter the Netherlands in early 2022, then Belgium and Luxembourg. By 2025, it wants to expand the concept to 11 countries across Europe. The international expansion is underpinned by Driverama’s parent company, Aures Holdings, the largest independent used-car retailer in Europe.

Acquisition or physical expansion

Eventually, online-only used-car businesses could be absorbed by another company that has greater access to premium used cars and a wider, physical network. ‘I believe that an omnichannel approach, like those with a network are suggesting, is the more sustainable approach,’ said Engelskirchen.

‘I could also imagine a future without an online-only used-car sales approach altogether, because in order to deliver an end-to-end customer experience across the entire value chain, a network can create a particularly attractive USP,’ he added.

Acquisition is not the inevitable outcome, however. Driverama will not be an online-only venture. It will start with four physical locations this year and increase up to 24 facilities in 2022. The company will also be able to leverage Aures’ network of 45 sites and preparation centres across Europe.

The challenges for online-only used-car remarketing are therefore numerous, but not necessarily insurmountable. Used-car retailers certainly have a role to play in an increasingly digital world that is also seeing high, if not record, demand for used cars as the world grapples with economic recovery and rising inflation, as well as supply-chain problems in the wake of COVID-19, including semiconductors for new cars.

‘Looking ahead, as the demand for used cars continues to grow, the players with the leading tech platforms and strongest offer to the customer will take more of the market share, which is an exciting opportunity for brands like Driverama,’ Galik concluded.