Jubilee effect masks June improvement in UK new-car market

06 July 2022

New-car registrations in the UK suffered their greatest year-on-year decline last month since October 2021. However, there were two fewer working days than a year earlier due to the Queen’s Platinum Jubilee and adjusted for this, the downturn was far less dramatic than in May.

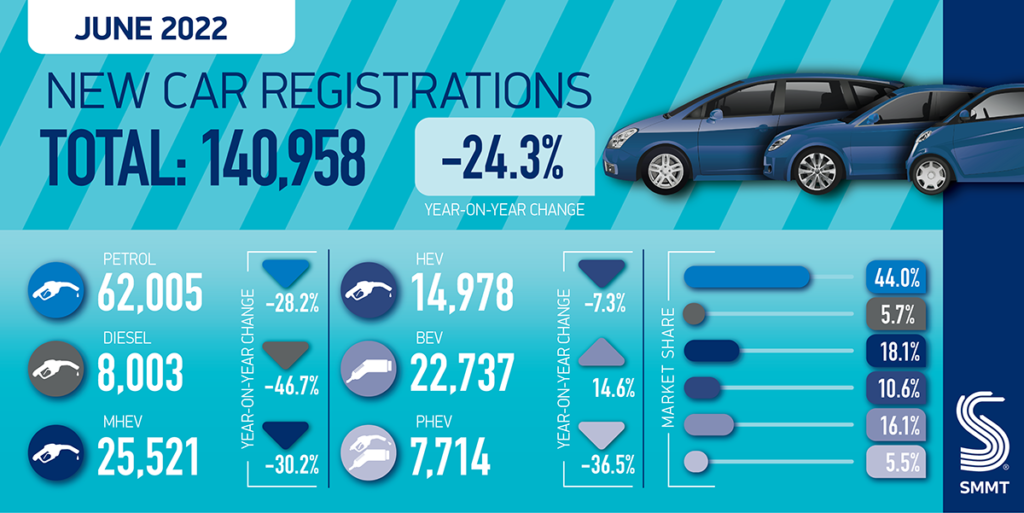

The latest figures from the Society of Motor Manufacturers and Traders (SMMT) show that the new-car market declined by 24.3% in June. ‘The month saw 140,958 new vehicles registered, the weakest June performance since 1996,’ the SMMT noted.

However, adjusted for working days, Autovista24 estimates that the year-on-year fall was 16.7%. This marks a major improvement on the adjusted 28.2% downturn in May, with the seasonally-adjusted annualised rate (SAAR) increasing from 1.45 million units to 1.62 million.

The volume of UK new-car registrations last month aligned perfectly with Autovsita24’s forecast, which factored in both the Platinum Jubilee and an improvement in the supply situation. Therefore, the June result confirms the recovery of the industry, a trend mirrored in France, Italy, and Spain, as well as in Germany.

PiCG ends, inflation and interest rates rise

UK new-car registrations in the first half of 2022 declined by 11.9% year on year to 802,079 units. This is ‘the weakest first half-year performance since 1992, bar 2020 – despite 2021 demand being restricted by dealership lockdowns until April, with consumers only able to buy vehicles through click and collect,’ the SMMT explained.

‘Given the ongoing shortages of essential components, exacerbated by pandemic restrictions in China, global vehicle production has struggled to keep up with demand throughout 2022,’ the association added. Although the UK new-car market performed in line with Autovista24’s expectations for June and supply is improving, there are challenges ahead for demand.

The consumer prices index (CPI) rose by 9.1% in the twelve months to May 2022, up from 9% in April, and is likely to exceed 10% in the coming months. There was another interest-rate hike in June too, to 1.25%, with more expected throughout the year. Furthermore, the UK government has ended the plug-in car grant (PiCG), which offered up to £1,500 (€1,740) off the cost of a new electric car.

In this context, Autovista24 has revised its forecast for UK new-car registrations in 2022 downward, to below 1.7 million units. This equates to year-on-year growth of 3.1%, and a 26.5% contraction compared to the pre-pandemic level of 2019. As countless orders will not be fulfilled this year, the weaker demand assumption means the registrations outlook for 2023 has also been reduced, from 2.19 million units to 2.11 million units.

Electric vehicles ‘the one bright spot’

As the PiCG was only withdrawn on 14 June and orders can take months to translate into registrations, the electrification of the UK new-car market continued last month.

Despite the 24% contraction of the wider market, registrations of battery-electric vehicles (BEVs) grew 14.6% year on year to gain a 16.1% share of the market, up from 10.7% a year earlier. Hybrid-electric vehicles (HEVs) performed comparatively well too, falling by only 7.3% and extending their market share to 10.6%.

Conversely, the share of plug-in hybrid vehicles (PHEVs) fell to 5.5%, from 6.5% in June 2021. Nevertheless, ‘plug-in vehicles comprised more than a fifth (21.6%) of new cars joining the road in the month,’ the SMMT noted.

‘Electric-vehicle demand continues to be the one bright spot, as more electric cars than ever take to the road, but while this growth is welcome it is not yet enough to offset weak overall volumes, which has huge implications for fleet renewal and our ability to meet overall carbon reduction targets,’ said SMMT chief executive Mike Hawes.

Electric vehicles (EVs), comprising BEVs and PHEVs, accounted for a record one in five new-car registrations in the first six months of 2022. 'The pace of this growth, however, is decelerating, with registrations up by 26% in the first half of 2022, compared with growth of 161.3% during the first half of 2021,’ the SMMT highlighted.

The termination of the PiCG, along with rising interest rates and inflation, will have a detrimental impact on EV uptake. It also means ‘the UK is now the only major European market without purchase incentives for private EV buyers,’ the SMMT noted.

‘With motorists facing rising fuel costs, however, the switch to an electric car makes ever more sense, and the industry is working hard to improve supply and prioritise deliveries of these new technologies given the savings they can afford drivers,’ Hawes concluded.