Monthly Market Update: Residual values cling on as used-car balance tips from demand to supply

02 December 2022

Used-car sales volumes receded month on month across European markets in November, whereas supply improved. The balance has therefore tipped from demand to supply, but residual values (RVs) are clinging on to growth in most markets. However, used-car prices are now falling in Spain and the UK.

RV growth in absolute terms continues to outpace list-price changes. Average prices of three-year-old used cars, represented as a retained percentage of their original list price (%RV), also gained in November except in Spain and the UK. Although, the month-on-month deviations were all in a narrow range of -0.8% in the UK to 1.5% in Italy.

New-car registrations in Europe enjoyed their third consecutive month of year-on-year growth in October. The 14.1% gain far exceeded the 7.9% growth recorded in September, although the base of comparison was lower. These figures confirm the ongoing improvement in new-car supply, which has been constrained by pre-existing semiconductor shortages as well as additional challenges caused by the war in Ukraine and COVID-19 lockdowns in China.

But, the situation is only slowly improving and the Autovista24 outlook for new-car registrations in Europe in 2022 and 2023 is poorer as business and private buyers contend with rising inflation and interest rates as well as economic uncertainty. The COVID-19 pandemic significantly derailed the European new-car market from March 2020 onwards, which will acutely reduce the volume of cars de-fleeting after three years.

This means undersupply into the used-car market is expected to persist in the coming years, which would ordinarily support RVs. However, the cost-of-living crisis will also erode consumer demand for used cars. The net effect of supply challenges and diminishing demand means Autovista24 forecasts that the %RV will only edge forward, if not decline, across European markets in 2023 and 2024.

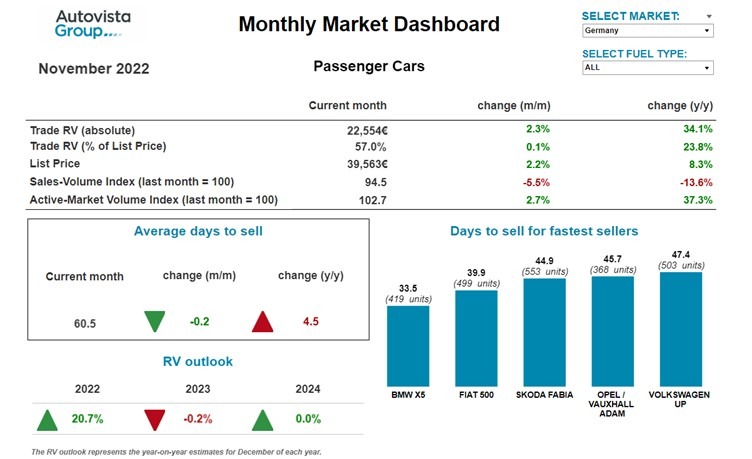

The interactive monthly market dashboard features Austria, France, Germany, Italy, Spain, Switzerland, and the UK. It includes a breakdown of key performance indicators by fuel type, including RVs, new-car list prices, selling days, sales-volume and active market-volume indices.

Scenario analysis

There are upside and downside risks to this base-case scenario. Used-car prices will come under greater pressure if the economic situation deteriorates in Europe, with a more negative impact on demand. This would be compounded if there are significant supply improvements.

For example, lower demand for consumer electronics could see a quicker resolution of the semiconductor shortages in the automotive industry. According to VNC Automotive, the ‘semiconductor drought could soon become a flood of chips.’

Conversely, there are risks of greater disruption to new-car supply, which would benefit used-car prices. Automotive suppliers could succumb to mounting costs and economic headwinds. The risk of the war in Ukraine escalating also remains, with potential consequences for Europe’s fragile automotive supply chain. Any unforeseen improvement in used-car demand, especially if fewer new cars can be delivered, would also push RVs higher.

Demand weakens in Austria

‘As elsewhere in Europe, living costs are rising in Austria and used-car transaction activity is slowing down compared to the first half of the year,’ noted Robert Madas, Eurotax (part of Autovista Group) regional head of valuations, Austria, Switzerland, and Poland.

The sales-volume index clearly shows weakening demand with declines of 5.3% compared to October and 25.6% versus November 2021. Hybrid-electric vehicles (HEVs) have been the most heavily impacted with the sales volume down 40% year on year.

Conversely, the supply volume of passenger cars aged two-to-four years in November was 1.1% higher than a month earlier and 11.2% higher than in November 2021. However, supply was significantly lower in 2021 than at the beginning of 2020.

Average days to sell have increased significantly to 69.4 days. This development also confirms the slowdown in used-car demand. Battery-electric vehicles (BEVs) are currently selling the fastest, averaging 57.2 days, followed by HEVs with 61.4 days, petrol cars with 68.7 days, and diesel cars with 70.2 days. Plug-in hybrids (PHEVs) are selling the slowest, averaging 71.3 days.

Despite weakening demand and improving supply, RVs of 36-month-old cars have increased slightly. The average %RV increased by 0.9% month on month in November, with cars retaining 54.8% of their list price on average. This is a solid 20.7% year-on-year gain.

HEVs are currently leading with a trade value of 56.6%, followed closely by PHEVs (55.3%), diesel cars (55.2%), and petrol cars (54.5%). Meanwhile, 36-month-old BEVs retain the lowest value, at 53.3% of list price.

Although used-car demand is set to cool, the supply side will not change in the medium term because new-car registrations are still markedly lower than before the crisis. 2021 was down 27% compared to 2019, and the outlook for 2022 is even below last year’s volume. The market parameters will therefore not change significantly in the medium term.

Madas forecasts RVs of three-year-old used cars will remain high and end 2022 approximately 17% up on December 2021. For 2023 and 2024, Madas expects RVs to decrease by between 2% and 3% year-on-year due to weakening demand.

RV gains slow in France

The French used-car sector changed in 2022, with the %RV gaining 6.2% year on year in November. However, there has been a significant downturn in used-car sales since the beginning of the year. This is mainly linked to the long delivery delays for new cars and higher prices for both new and used models.

‘Prices of used BEVs have increased the most as RVs were low when first appearing on the market as the technology was not developed enough to provide sufficient range. This reduced the usability of vehicles and, in turn, the number of customers,’ explained Ludovic Percier, residual value and market analyst, France, at Autovista Group.

Petrol cars have enjoyed the second highest gains, followed closely by diesel cars. ‘High-powered petrol cars have especially increased in value, due to their rarefication on the new-car market amid the increased malus (purchase penalty), which can now cost up to €40,000,’ Percier added.

As new-car buyers have switched from diesel to petrol or other fuel types over the past couple of years, offers have reduced on the used-car market and prices have risen. Even with the introduction of more low-emission zones (ZFEs) and the poorer image of diesel, Percier believes RVs will still increase as used demand remains stable and supply diminishes. This is also because ZFEs are only in cities with a population of over 150,000, which does not target high-mileage drivers. Accordingly, Percier does not foresee a bigger impact on the RVs of used diesels until 2024 and 2025.

Plug-in hybrids have gained in value this year too, thanks to longer ranges and improved acceptance in the market. However, this trend has reversed over the past couple of months, with values down month on month in November in absolute terms, and this will be reinforced from mid-2023.

Overall, RVs continue to rise in France due to higher list prices and lower offers of used cars on the market. However, the gains are lower as private buyers focus increasingly on older cars and/or lower segments because of tighter budgets. Used cars aged over 12 years are suffering the least from weakening demand, showing that buyers are no longer following price increases.

‘We expect RVs to continue to increase next year in absolute terms, as list prices of new cars also rise, but a decline in the %RV is anticipated by 2024. We are in a bubble market that should explode soon,’ Percier concluded.

Remarketing boost in Germany

The German new-car market is slowly recovering. Especially in the fleet sector, where vehicles that were ordered a long time ago have finally been produced and are now being registered.

‘This is positive news for the used-car market, whereby almost every new fleet vehicle also means a young vehicle is returned and freed up for remarketing. Thus, the quantities available are slowly growing again and offer buyers more choice,’ explained Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group).

Stock days are growing accordingly, although vehicles are still showing stable selling days for now. As production capacities continue to develop, the question arises as to whether more of the delivered new vehicles will again be registered through dealer and manufacturer channels.

‘While this would be conducive to volume recovery, it could at the same time put pressure on residual values by weighing down prices of very young used cars. A kind of fatigue effect in the previous upward spiral of used-car prices can already be observed even without this price pressure,’ Geilenbruegge noted.

Although average prices for three-year-old cars continue to rise, list prices of vehicles under consideration are rising almost identically. This means that the used-car price increase is essentially the result of more expensive vehicles flowing into the market. Accordingly, the adjusted %RV shows stagnation across most fuel types, except for PHEV gains and BEV losses.

For the remaining weeks of 2022, one or two attractive returns will presumably arrive at dealerships. However, there should be no pressure to sell and the usual price drop at the end of the year is not anticipated. The forecast for this year, i.e. the comparison of December 2022 against December 2021, is disproportionately higher than for the coming years.

Nevertheless, ‘a value plateau at a high level can be expected until at least 2025. Only dwindling purchasing power will put a stop to the price surge and will not make every retailer’s desired sales price possible,’ Geilenbruegge added.

RV trend continues in Italy

The RV trend in Italy continues to indicate slight but steady growth, with no major changes expected before the end of 2022. A vehicle registered three years ago with 60,000km retains 51.4% of its original list price, a 1.5% month-on-month increase.

‘We expect further modest growth for 2023, estimated at around 1.6%, while from 2024 we believe the %RV will start on a slow downward path (-1.9%) due largely to the gradual resolution of production, supply, and delivery problems,’ commented Marco Pasquetti, head of valuations, Autovista Group Italy.

All fuel types have experienced strong price growth compared to 2021 but the %RV of BEVs and compressed natural gas (CNG) cars declined by 1.6% and 2.3% respectively month on month. For the latter, the increase in fuel costs is weighing heavily, as discussed in recent months.

Hybrid vehicles are still experiencing a growth phase, with an increase compared to October of 5.9% for full hybrids and 5.1% for plug-in hybrids. HEVs are selling the fastest, at an average of just over 47 days, with some models such as the Honda CR-V, Kia Niro and Toyota C-HR even selling in less than 20 days. ‘This interest is also confirmed by positive sales figures in the new-car market, a sign that Italians are finally starting to focus on the benefits of automotive electrification,’ Pasquetti explained.

‘Impoverished profile’ in Spain

Although the Spanish new-car market grew by 11.7% year on year in October, the market is still down 5.8% in the year-to-date. With only two months to go before the end of the year, the total number of passenger cars registered amounts to 666,247 units.

Meanwhile, Spain’s used-car market has contracted for nine consecutive months and declined 4.8% year on year between January and October. With 1,552,237 changes of ownership, this equates to a ratio of 2.3 used cars for every new car sold.

‘In addition to the general loss of volume, the problem of an impoverished profile persists. With an increasingly depleted stock of young used vehicles, the bulk of transactions are for vehicles over eight years of age,’ explained Ana Azofra, Autovista Group head of valuations and insights, Spain.

Although networks and dealers are increasingly integrating these older vehicles into their offerings, this segment is still very much dominated by private sellers. We are therefore at a time of lower transaction volumes, compensated in the distribution networks by higher profitability,’ she added.

A three-year-old used car with 60,000km on the clock is selling on average for 21% more than a year ago. However, prices seem to have peaked, with the %RV falling 0.7% month on month.

On the one hand, ongoing supply shortages will lead to a certain amount of stability. On the other hand, the economic crisis and connected rise in interest rates are holding back demand and, therefore, the used-car market.

‘By fuel type, we see modest falls in the %RV development of internal-combustion engine (ICE) vehicles in 2023 and a healthier evolution of hybrid and electric vehicles. The outlook for BEVs is somewhat more restrained than for HEVs but is also positive. The only electrified vehicles expected to buck the trend with a negative development are PHEVs, with their high prices and limited advantages. Regulations could yet accelerate their decline,’ Azofra concluded.

Supply improves in Switzerland

The Swiss used-car market is showing signs of increasing supply, but it is still at a lower level than before the COVID-19 pandemic. Now with rising living costs, used-car transactions are slowing down compared to the first half of the year.

Across all two-to-four-year-old passenger cars, the supply volume in November was 3.4% higher than a month earlier and 37.6% higher than in November 2021. But supply was significantly lower in 2021 than at the beginning of 2020. Meanwhile, the sales-volume index shows weakening demand, with a 4.8% fall compared to October and a 16.8% decline year on year. HEVs have been impacted the most, with sales volumes down 40% year on year.

Despite weakening demand, the average value retention of 36-month-old passenger cars grew slightly to 51.7% in November (up 0.5% month on month and up 15.8% year on year). BEVs posted particularly strong year-on-year %RV gains of 25.2%. Nevertheless, petrol cars are currently leading, retaining 52.4% of their original list price, followed by BEVs (50.6%), diesel cars (50.4%), and HEVs (49.5%). 36-month-old PHEVs retain the lowest value, at 48.9% of their list price.

The average days to sell increased in November, with a passenger car aged two-to-four years in stock for 70 days. BEVs are selling quickest, after an average of 55 days, followed by petrol cars and PHEVs after 70 days, diesel cars after 71 days, and HEVs after 76 days.

‘The disrupted supply of new cars, exacerbated by the war in Ukraine, and recent list-price increases are key factors in the future development of RVs. Supply chains are still significantly affected, leading to long delivery times for many new vehicles,’ commented Hans-Peter Annen, head of valuations and insights, Eurotax Switzerland (part of Autovista Group).

As the demand is likely to weaken further, pressure on RVs is to be expected. However, supply will not improve significantly in the medium term as new-car registrations in 2022 are markedly lower than before the COVID-19 pandemic (2021 was down 23.4% compared to 2019). Annen forecasts that RVs of three-year-old used cars will remain high and finish 2022 13.8% up on December 2021.

‘The market parameters will not significantly change in the medium term, even as used-car demand cools. For the years 2023 and 2024, we expect RVs to fall by about 3% year on year due to weakening demand,’ Annen added.

UK follows depreciation pattern

The UK’s used-car market followed a depreciation pattern in November. The average %RV at three years of age fell by just under 1% month on month, to 62% of the original price. Compared to November 2021, the average %RV is down 0.7% – surprisingly, the first month in 2022 where it has dipped below last year.

‘This is quite extraordinary when we consider that values increased by some 30% in 2021. So, despite reasonably lacklustre retail demand, values have remained high throughout 2022, a reflection of the lack of used stock flowing into the market. This is confirmed by the active-market volume index, which shows a year-on-year decline in available stock of over 26% during November,’ explained Jayson Whittington, Glass’s (part of Autovista Group) chief editor, cars and leisure vehicles.

Looking ahead to 2023, Whittington stressed the importance of recognising that most households in the UK have already experienced shrinking disposable incomes. Energy costs increased earlier this year, and while consumers have been protected from the full impact of wholesale price rises by the UK Government’s Energy Price Guarantee, this cap is due to be raised in April 2023 – adding £500 (€578) to the average annual bill.

In addition, consumers are facing sharp inflationary pressures affecting many everyday essentials. Recent interest-rate hikes have also significantly added to the burden of mortgage holders, with the cost of car finance also increasing.

‘It therefore seems inevitable that the UK will enter a recession as consumers grapple with a new reality. A recession does not necessarily spell danger for the used-car market though. Past recessions have shown that the used-car market is very resilient as consumers tend to continue buying cars. However, they will perhaps look at a cheaper model or buy a used car instead of new,’ Whittington surmised.

It is also important to remember that three years ago in March, the UK began to experience the effects of COVID-19 lockdowns, which kicked off the start of new-vehicle supply constraints. Therefore, fewer cars will be returning to the used-car market in 2023, which will help to prop up RVs.

‘So, despite some challenging times ahead, Glass’s does not expect residual values to come under serious pressure, although a downward correction in the region of 5% is likely,’ Whittington concluded.

The November 2022 monthly market dashboard provides the latest pricing, volume and selling-days data.