UK registrations falter in June as production issues hamper deliveries

05 July 2021

The recovery of the UK’s new-car registrations stalled in June, as figures failed to continue the trend for month-on-month improvements when compared to 2019 and adjusted for working days.

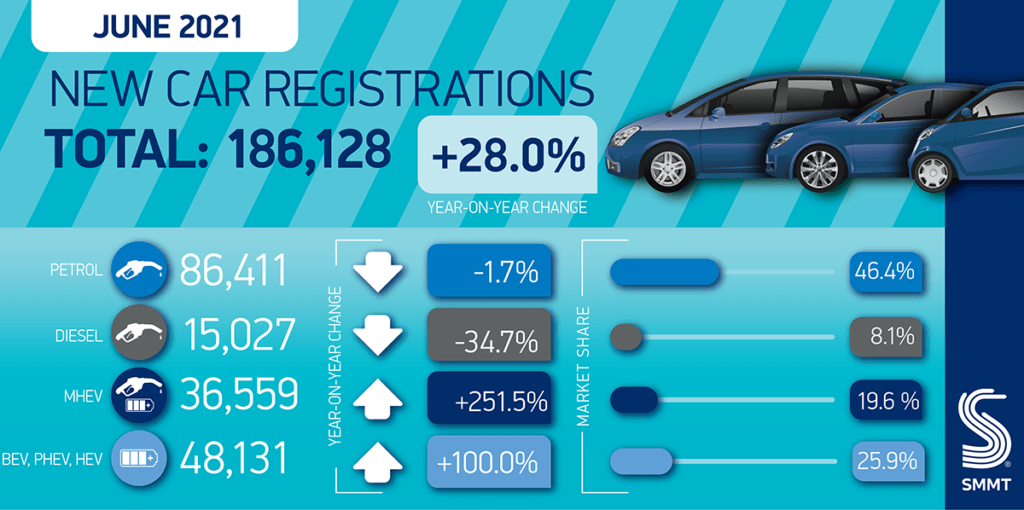

In total, 186,128 new vehicles were registered in the country last month. This represents a decline of 16.7% on figures from two years ago, which offers a more stable base to compare against. Despite growth of 28% year-on-year, these numbers are almost meaningless, as the UK market was emerging from its first COVID-19 lockdown in June 2020, with dealerships closed for a period during that month.

As the rest of the year fluctuated due to the impact of the pandemic, only comparisons against 2019 can highlight how well new-car registration figures are currently performing. June is traditionally the third strongest month of the year in the UK. Figures released by the Society of Motor Manufacturers and Traders (SMMT) show that uptake of new cars was 16.4% down on the 10-year average. The industry body is attributing some of the drop in sales to the ongoing issues surrounding semiconductor supply.

The 16.7% drop is worse than May’s figures (14,7%). However, considering that there were two more working days in June 2021 when comparing numbers, Autovista24 calculates a 24.3% decline upon adjustment. With May’s adjusted figure of -5.7%, this shows the struggle the UK market has ahead of it.

To further highlight this, the Seasonally Adjusted Annualised Rate, which reached its highest level since August 2020 in May, has dropped significantly, to around 1.98 million units, the lowest since March this year. For Q2, the UK market is 14.7% down, and overall year-to-date registrations have fallen 28.3% compared to 2019. While it was expected that pent-up demand from the first four months of the year, when dealerships were closed due to further lockdown measures, would run out, the decline is also down to the availability of models on the market. Many carmakers are struggling with vehicle production due to a shortage of semiconductors, causing a delay in deliveries. As the UK’s vaccination programme continues to roll out and consumer confidence increases, this may now be the most pressing challenge the industry faces.

‘The automotive sector is now battling against a ‘long-COVID’ of vehicle supply challenges,’ commented SMMT chief executive Mike Hawes. ‘The semiconductor shortages arising from COVID-constrained output globally are affecting vehicle production, disrupting supply on certain models and restricting the automotive recovery. However, rebuilding for the next decade is now well underway, with investment in local battery production beginning and a raft of new electrified models in showrooms. With the end of domestic restrictions later this month looking more likely, business and consumer optimism should improve further, fuelling increased spending, especially as the industry looks towards September and advanced orders for the next plate change.’

BEV popularity grows

The UK market is looking towards the next decade, where petrol and diesel engines will be removed from new-car forecourts and replaced with hybrid, plug-in hybrid (PHEV) and battery-electric vehicles (BEV) only from 2030. By 2035, only new zero-emission vehicles will be sold.

Looking at fuel-type figures compared to 2020, petrol sales declined 1.7% year-on-year in June, while diesel continued its rapid fall from grace. Sales of the technology were down by 34.7%, giving the fuel-type a market share of just 8.1%. Mild-hybrids saw registrations increase 251.5% for a market share of 25.9%, while hybrid, PHEV and BEV sales increased 100%. A total of 48,131 electrified units were registered in June, over half the amount of petrol-engine vehicles and gaining a market share of 19.6%. BEVs were the most sought-after of these three fuel types, with a total 6.5% market share and 19,842 units registered in June.

The popularity of BEV technology was further highlighted by the fact that the Tesla Model 3 was the best-selling car in the UK in June, ahead of the Volkswagen Golf and Ford Puma. Meanwhile, traditional market leaders, the Vauxhall Corsa and Ford Fiesta were only 4th and 5th in the sales figures.

But while Tesla can claim the spoils in the month, the manufacturer does not feature in the top 10 based on year-to-date figures. This is still dominated by vehicles with an internal-combustion engine (ICE), with no BEV models featuring so far. The Corsa remains the most popular car this year, with the Fiesta in second and the Golf third.

Action needed

This increasing uptake of BEVs only adds to the SMMT’s calls for government support during the transition from ICE to zero-emission technologies. There are fears that if no action is taken, the country could fall behind others in the race to electrify. Convincing most of the public to switch to a new propulsion technology in eight-and-a-half years is a big challenge.

To aid this, the SMMT suggests that the government needs to continue the ‘plug-in vehicle incentives’ beyond their current term and exempt ultra-low-emission vehicles (ULEVs) from taxation for the next five years.

The government should also develop an infrastructure strategy to ensure that at least 2.3 million public charging points are in place by 2030. That would require an additional 700 charging points per day being added to current totals.

However, the UK market has recently been buoyed by the announcement that Nissan, together with partner Envision AESC, will be building a battery gigafactory close to its plant in Sunderland. The carmaker also confirmed the production of a new model at the plant, with significant investments to carve out a sustainable future.