Used-car transactions retreat across Europe in first half of 2022

17 August 2022

The volume of used-car transactions retreated in all the big five European markets in the first half of 2022, explains Autovista24 senior data journalist Neil King.

The used-car markets of France, Germany, Italy, Spain, and the UK all contracted year on year in the first half of 2022. France and Germany endured the most pronounced declines, but even the UK fell 8.3% despite expanding by 5.1% in the first quarter. Nevertheless, compared to the performance of the respective new-car markets, Germany was the only country to see comparatively weaker used-car activity.

Mounting pressure on residual values

Used-car markets continue to be hampered by supply constraints stemming from new-car delivery delays. However, this has pushed some consumers towards used cars. The latest Monthly Market Update (MMU) confirms that residual values (RVs) enjoyed modest growth in July - even in the UK, where they had been falling.

The slow recovery of new-car markets contrasts with the deteriorating year-on-year performance of used-car transactions compared to the first quarter. This is especially the case in Germany, Spain, and the UK. Whereas new-car markets lost momentum in July, except in the UK, official data on used-car transactions in the month (available for France, Germany, Italy, and Spain) confirm a further deterioration of the year-on-year downturns in the first seven months of the year.

Furthermore, rising inflation and interest rates will not just curtail underlying demand for new cars, but also for used models as household budgets are squeezed. With improving supply and diminishing demand, Autovista Group forecasts that RVs will decline, or at best stabilise, across European markets in 2023 and 2024.

Germany, Spain, and the UK slump

Compared to the first six months of 2021, Germany’s used-car market declined 14.6% in the first half of 2022, with 2.88 million transactions. However, unlike other European countries, its new-car market fared better, dropping by 11%, KBA figures reveal. This gap widened in July, with used-car transactions down 16.4% in the first seven months of the year, compared to a 11.3% fall in new-car registrations.

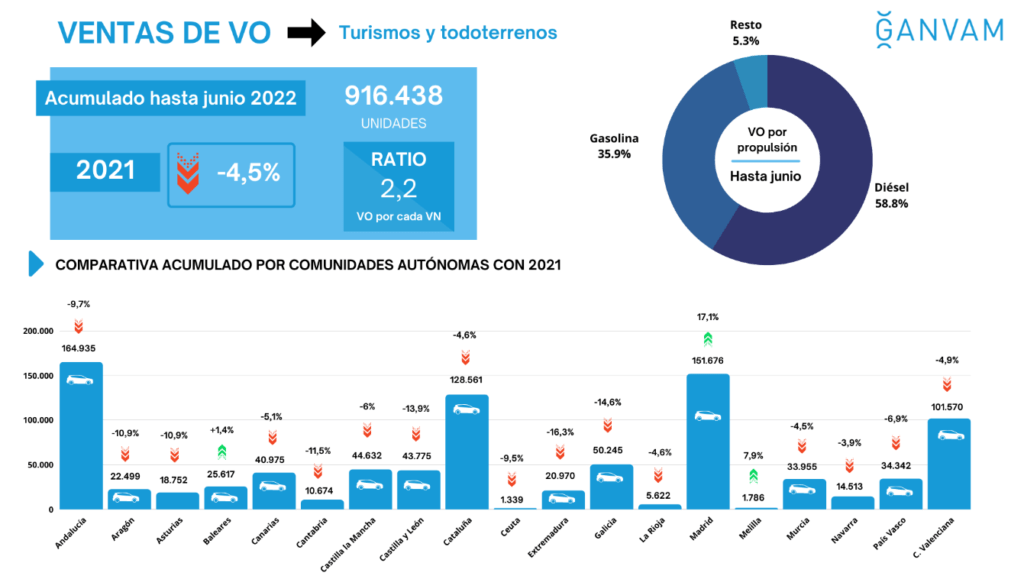

The number of used-car transactions in Spain fell by a comparatively resilient 4.5% in the first half of this year, down to 916,438 units according to dealers’ association GANVAM. Nevertheless, the market has worsened since the 1.8% decline in the first quarter. Meanwhile, the country’s new-car market has suffered a double-digit decline of 10.7%.

A 7.8% year-on-year fall in used-car transactions in July means the Spanish market is 4.7% weaker in the year-to-date, whereas new-car registrations are down 11%.

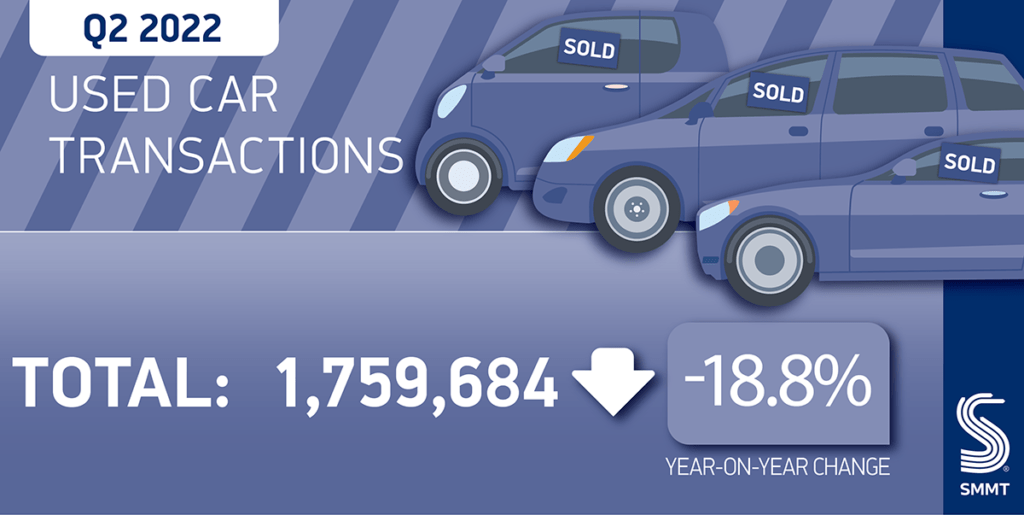

The UK’s Society of Motor Manufacturers and Traders (SMMT) reports that 3.5 million used cars changed hands during the first half of 2022, down 8.3% year on year. However, the market has endured a reversal of fortune, whereby the volume of transactions was down 18.8% in the second quarter, after growth of 5.1% in the first.

The SMMT did caution, however, that ‘the scale of this decline was artificially inflated by comparison with 2021 when the easing of COVID-19 restrictions saw the busiest second quarter since records began. By comparison, Q2 2022 was 13.5% behind pre-pandemic 2019.’

Nevertheless, the new-car market has struggled even more, with 11.9% fewer registrations than in the first half of 2021.

‘It was inevitable that the squeeze on new-car supply would filter through to the used market. Despite this, Britain’s used-car buyers clearly have a growing appetite for the latest low- and zero-emission cars, and we need a thriving new-car market to feed it,’ concluded SMMT chief executive Mike Hawes.

Weakness persists in France and Italy

In the first six months of 2022, France saw its used-car market decline by 12.4% year on year, with 2.73 million transactions, according to figures published by AAA Data. This marked a slight deterioration from the 11.2% year-on-year decline in the first quarter, but still compared favourably with the 16.3% downturn in the new-car market.

‘Although all age groups are down, models under five years old (-28.4%) remain the most affected due to the fall in new-car sales since 2020. Those between five and 10 years old are down 17% and the oldest, 10 years and older, only 9.1%,’ AAA Data commented. Used-car transactions fell by 19.5% in July, lowering the year-to-date comparison to 13.5%.

In Italy, industry association ANFIA reports a total of 2.42 million used-car transactions in the first half of 2022, equating to a year-on-year fall of 7.1%. With a 17.5% contraction in July, however, the used-car market is down 8.6% in the first seven months of the year, essentially maintaining the 8% fall in the first quarter. New-car registrations have suffered the biggest drop among the big five European markets, contracting 22.7% in the first half of 2022, although this improved slightly to a 20.3% cumulative decline through July.